FIAT GROUP CLOSES 2013 POSTING TRADING PROFIT OF €3.4 BILLION AND NET INDUSTRIAL DEBT OF €6.6 BILLION WITH A SIGNIFICANT REDUCTION IN LOSSES IN EMEA, THE PREMIUM STRATEGY YIELDING PROMISING INITIAL RESULTS, AND STRONG CASH GENERATION OF €1.7 BILLION IN THE FOURTH QUARTER.

- Worldwide shipments were up 3% over the prior year to 4.4 million units, driven by growth in NAFTA and APAC which more than offset moderate contractions in LATAM and EMEA

- Jeep set an all-time global sales record for the second consecutive year of 732,000 vehicles.

- Revenues of €87 billion were up 3% in nominal terms, but grew 7% at constant exchange rates, with increases in NAFTA and APAC partially offset by reductions in LATAM and EMEA. Luxury Brands posted a strong year-over-year increase, with Maserati more than doubling over the prior year.

- Trading profit was €3.4 billion, down from €3.5 billion in 2012 (IAS 19 restated) but up by €0.1 billion on a currency adjusted basis; trading profit for 2013 also included €0.3 billion in higher R&D amortization mainly due to new product launches in NAFTA. EMEA reduced losses by €233 million to €470 million, mainly on the back of improved product mix and cost efficiencies. APAC posted a 38% year-over-year increase to €358 million. NAFTA was down 9% (-6% at constant exchange rates), driven primarily by higher industrial costs related to product launches and the associated increase in R&D amortization. LATAM decreased 41% (-33% at constant exchange rates) driven by input cost inflation, a less favorable production mix, lower volumes and a decrease in Venezuela profitability. Both Ferrari and Maserati posted significant year-over-year improvements, with Maserati tripling to €171 million.

- Net profit was €1,951 million (€896 million for 2012, IAS 19 restated), including a €1.5 billion positive impact from the recognition of net deferred tax assets related to Chrysler offset by €0.5 billion in net unusual charges. Excluding those items, net profit was €943 million (€1,140 million for 2012, IAS 19 restated).

- Net industrial debt at 31 December 2013 was €6.6 billion, down from €8.3 billion at the end of Q3, with strong Q4 cash flow generation of €1.4 billion from Chrysler and €0.3 billion from Fiat ex-Chrysler. The increase in net industrial debt for 2013 was therefore limited to €0.1 billion but excluding equity investments the cash flow for the year was positive by €0.1 billion. Chrysler closed the year with a net cash position of €0.2 billion.

- Total available liquidity at 31 December 2013, inclusive of €3.0 billion in undrawn committed credit lines, was €22.7 billion, up €2.6 billion from September-end. For Fiat ex-Chrysler, total available liquidity was €12.1 billion and for Chrysler €10.6 billion.

- The Group indicates the following guidance for 2014: revenues of about €93 billion, trading profit in the ~€3.6 to €4.0 billion range, net income in the ~€0.6 to €0.8 billion range, with EPS to improve from~€0.10 (ex-unusuals) to ~€0.44-€0.60 (guidance for net income takes into account increased deferred tax charge of ~€0.5 billion due to the recognition of net deferred tax assets at year-end 2013 related to Chrysler), net industrial debt in the €9.8 billion to €10.3 billion range. Guidance for net industrial debt includes cash outflows for the purchase of the remaining 41.5% minority stake in Chrysler Group LLC from the VEBA Trust (€2.7 billion), in addition to the impact of the adoption of IFRS 11, effective January 1st, 2014 (~€0.3 billion).

| FIAT GROUP Highlights |

| 4th Quarter | Full Year | |||||||||

| 2013(*) | 2012(**) | Change | (€ million) | 2013(*) | 2012(**) | Change | ||||

| 1,172 | 1,088 | 84 | Total shipments (000s) | 4,352 | 4,223 | 129 | ||||

| 24,001 | 21,775 | 2,226 | Net revenues | 86,816 | 83,957 | 2,859 | ||||

| 931 | 887 | 44 | Trading profit | 3,394 | 3,541 | -147 | ||||

| 456 | 807 | -351 | EBIT | 2,972 | 3,404 | -432 | ||||

| 1,684 | 1,836 | -152 | EBITDA (1) | 7,546 | 7,538 | 8 | ||||

| 2,167 | 1,948 | 219 | EBITDA ex-unusuals | 8,065 | 7,782 | 283 | ||||

| (74) | 337 | -411 | Profit /(loss) before taxes | 1,008 | 1,519 | -511 | ||||

| 1,296 | 224 | 1,072 | Net profit | 1,951 | 896 | 1,055 | ||||

| 252 | 336 | -84 | Net profit ex-unusuals (2) | 943 | 1,140 | -197 | ||||

| 0.707 | 0.005 | – | EPS (€) | 0.744 | 0.036 | – | ||||

| 0.026 | 0.099 | – | EPS ex-unusuals (€) (2) | 0.099 | 0.242 | – | ||||

| 6,649 | 8,307(3) | -1,658 | Net industrial debt | 6,649 | 6,545(4) | 104 | ||||

| 22,729 | 20,139(3) | 2,590 | Total available liquidity | 22,729 | 20,848(4) | 1,881 | ||||

| (*) Results for 2013 do not yet reflect the impact of new accounting standards IFRS 10-11-12 that the Group will adopt effective 1 January 2014; the opening balance at this date will reflect an increase in net industrial debt as reported at 31 December 2013 estimated in ~€300 million in connection with the adoption of IFRS 11 – Joint arrangements. No impact is expected from the adoption of the other standards.

(**) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €273 million for the FY (€100 million in Q4), Profit before Taxes reduced by €517 million for the FY (€166 million in Q4 ), Net Profit reduced by €515 million for the FY (€164 million in Q4). Shipments for 2012 adjusted to include Luxury brands. (1) EBIT plus Depreciation and Amortization. (2) Excluding net unusual charges and one-off net deferred tax assets.(3) At 30 September 2013. (4) At 31 December 2012. |

||||||||||

For 2013, Group revenues totaled €86.8 billion, up 3% over the prior year, representing a 7% increase at constant exchange rates (CER). On a regional basis, revenues in NAFTA were up 5% to €45.8 billion (CER +9%) on the back of higher volumes. LATAM reported revenues of €10 billion, down 10% in nominal terms (CER +1%). APAC was up 48% to €4.6 billion, driven by strong volume performance. For EMEA, revenues were down 2% to €17.4 billion, mainly reflecting volume declines in Europe during the first half. For Luxury Brands, revenues were up 31% to €3.8 billion, with Ferrari up 5% and Maserati more than doubling to €1.7 billion on the strength of new models introduced during the year. Components revenues were in line with FY 2012 at €8.1 billion (CER +4%).

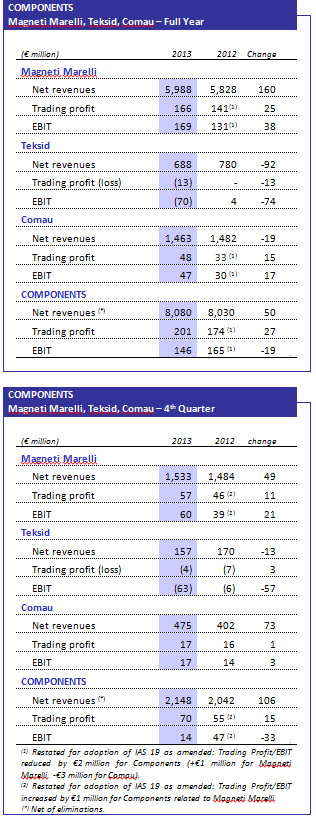

Trading profit was €3,394 million, down 4% over the prior year, but up 1% at constant exchange rates; trading profit for 2013 includes €0.3 billion in higher R&D amortization. NAFTA reported a trading profit of €2,220 million (€2,443 million for 2012, IAS 19 restated) down 9% in nominal terms (CER -6%), with positive volume and pricing more than offset by higher industrial costs, including content enhancements for new models and increased R&D amortization. LATAM posted a trading profit of €619 million (€1,056 million in 2012, IAS 19 restated) down 41% in nominal terms (CER -33%), with the decrease primarily due to input cost inflation, unfavorable production mix and lower result in Venezuela. APAC increased 38% to €358 million, driven by strong volume growth. In EMEA, losses were reduced by one-third to €470 million, mainly on the back of improved product mix and cost efficiencies. For Luxury Brands, trading profit increased by 36% to €535 million, with Ferrari up 9% to €364 million, and Maserati tripling from the prior year’s level to €171 million. For Components, trading profit was 16% higher at €201 million (CER +21%).

EBIT was €2,972 million (€3,404 million for 2012, IAS 19 restated). Net of unusuals, there was a year-over-year decrease of 4% to €3,491 million (€3,648 million for 2012, IAS 19 restated).

For full-year 2013, net unusual expense of €519 million included ~€390 million in asset write-downs mainly associated with the rationalization of architectures associated with the new product strategy, particularly for the Alfa Romeo, Maserati and Fiat brands, as well as charges related to asset impairments for the cast-iron business in Teksid. In addition there was a €56 million write-off of the book value of the Equity Recapture Agreement Right considering the agreement closed in January 2014 to purchase the remaining minority equity stake in Chrysler from the VEBA Trust[1]. Other unusual charges in the year were the €115 million charge related to the June 2013 voluntary safety recall and customer satisfaction action in NAFTA and the net €43 million charge related to the February 2013 devaluation of the Venezuelan bolivar (VEF) relative to the U.S. dollar, offset by the €166 million gain following amendments to Chrysler’s U.S. and Canadian salaried defined benefit pension plans. For 2012, there was net unusual expense of €244 million.

For mass-market brands by region, NAFTA reported EBIT of €2,290 million, an 8% decrease over 2012 (IAS 19 restated) mainly reflecting lower trading profit and higher positive net unusual items. LATAM posted EBIT of €492 million (€1,025 million in 2012), reflecting lower trading profit performance and higher net unusual charges. APAC increased 25% to €318 million, with higher trading profit partially offset by losses in the Chinese joint ventures due to industrial costs related to new product launches. During the period, EMEA reduced losses by €217 million to €520 million, reflecting a reduced trading loss and lower contribution from equity investments. Luxury Brands posted EBIT of €470 million (€392 million for 2012), with the trading profit improvement partially offset by €65 million in unusual charges. For Components, the EBIT was €146 million (€165 million for 2012), with net unusual charges of €60 million (€11 million for 2012).

Net financial expense totaled €1,964 million, an increase of €79 million over 2012. Excluding the impact of the Fiat stock option-related equity swaps (gains of €31 million for 2013, at their expiration, compared to €34 million for 2012), net financial expense increased by €76 million, largely due to a higher average net debt level.

Profit before taxes was €1,008 million (€1,519 million for 2012, IAS 19 restated). The €511 million decrease reflected the €432 million decrease in EBIT and higher net financial expense.

Income taxes were a positive €943 million, including a positive one-off of €1,500 million from the recognition of net deferred tax assets related to Chrysler. Net of this item, income taxes were a cost of €557 million (€623 million for 2012), of which €244 million for Fiat excluding Chrysler primarily related to the taxable income of companies operating outside Italy and employment-related taxes in Italy.

Net profit was €1,951 million (€896 million for 2012, IAS 19 restated), of which €904 million was attributable to owners of the parent (€44 million for 2012). Excluding unusual items and the positive deferred tax impact, net profit was €943 million (€1,140 million for 2012, IAS 19 restated). On the same basis, Fiat ex-Chrysler reported a net loss of €911 million (€787 million in 2012).

Net industrial debt at 31 December 2013 was €6.6 billion and increased by €0.1 billion for the year. Net of equity investments, the cash flow was a positive €0.1 billion, with cash absorption for Fiat ex-Chrysler of €1.6 billion more than compensated for by cash generation from Chrysler.

In 2013, total capital expenditure for the Group was €7.4 billion, substantially in line with 2012 (€7.5 billion), but 3% higher at constant exchange rates. For Fiat ex-Chrysler, capital expenditure was €3.9 billion, an increase of 20% over 2012 (€3.2 billion), or 25% at constant exchange rates. For Chrysler, capital expenditure totaled €3.6 billion for the period (€4.3 billion in 2012).

Working capital contributed €1.5 billion (€0.7 billion in 2012), of which €1.1 billion for Fiat ex-Chrysler (€0.6 billion absorption in 2012) and 0.3 billion from Chrysler (€1.3 billion in 2012).

Total available liquidity, inclusive of €3.0 billion in undrawn committed credit lines, was €22.7 billion, a €1.9 billion increase over December 2012, mainly reflecting the positive contribution from financing activities throughout the year, net of €1.0 billion in negative currency translation effects. For Fiat ex-Chrysler, total available liquidity was €12.1 billion (€11.1 billion at 2012 year-end) and for Chrysler the total was €10.6 billion, negatively impacted by currency translation of €0.6 billion for the full year. In 2013, Fiat issued a total of €2.9 billion in bonds under the GMTN program and repaid €1.0 billion at maturity, in addition to renewing a €2.1 billion syndicated revolving credit facility. Chrysler took advantage of favorable market conditions and its improved credit profile to reduce interest costs and amend certain covenants on the US$3.0 billion Tranche B Term Loan and the undrawn US$1.3 billion revolving credit facility.

Fourth Quarter

Group revenues were €24 billion for the period, up 10% in nominal terms and 16% at constant exchange rates. On a regional basis, revenues in NAFTA were €13.3 billion, up 17% in nominal terms (CER +22%). LATAM reported revenues of €2.2 billion, a 23% decrease year-over-year (CER -13%), compared with a particularly strong Q4 2012 supported by sales tax incentives in Brazil. APAC increased 62% to €1.3 billion. In EMEA, revenues totaled €4.4 billion, a decrease of 3% year-over-year. Luxury Brands increased revenues by 66% to €1.3 billion, driven by Maserati. For Components, revenues totaled €2.1 billion, up 5% over the prior year in nominal terms (CER +10%).

Trading profit totaled €931 million for Q4 2013, up 5% over the prior year (+11% CER). NAFTA reported a trading profit of €620 million (€555 million for 2012, IAS 19 restated), up 12% in nominal terms (CER +17%), driven primarily by the contribution of new models. LATAM posted a trading profit of €44 million (€57 million at CER), down €198 million from the prior year, as a result of input cost inflation, unfavorable mix and lower volumes. APAC increased 37% to €63 million. In EMEA, losses were reduced by €70 million or ~60% to €50 million, benefiting from improved product mix and industrial efficiencies. For Luxury Brands, trading profit increased by 74% to €223 million, driven by the strong performance of Maserati (up €110 million to €123 million). Components were up €15 million to €70 million.

In Q4 2013, EBIT was €456 million (€807 million for Q4 2012, IAS 19 restated). Net of unusuals, EBIT increased 2% to €939 million.

In Q4 2013, net unusual expense of €483 million mainly related to ~€390 million in asset write-downs mainly associated with the rationalization of architectures associated with the new product strategy particularly for the Alfa Romeo, Maserati and Fiat brands as well as charges related to asset impairments for the cast-iron business in Teksid. In addition there was a €56 million write-off of the book value of the Equity Recapture Agreement Right considering the agreement with the VEBA Trust[2].

For mass-market brands by region, NAFTA reported EBIT of €621 million, an 11% increase over Q4 2012 (IAS 19 restated) mainly reflecting higher trading profit. LATAM posted a negative €28 million (€242 million positive in Q4 2012), reflecting lower trading profit and increased net unusual charges. APAC increased by 33% to €48 million. For EMEA, EBIT was a negative €216 million (negative €164 million in Q4 2012), with the reduction in trading loss being more than offset by higher net unusual charges. Luxury Brands posted EBIT of €158 million (€128 million for Q4 2012). For Components, the total was €14 million (€47 million for Q4 2012), with net unusual charges of €56 million (€8 million in Q4 2012).

Net financial expense totaled €530 million, an increase of €60 million over the same period in 2012. Excluding the impact of the Fiat stock option-related equity swaps (loss of €29 million for Q4 2013, at expiration, and gain of €4 million for Q4 2012), net financial expense increased by €27 million.

Loss before taxes was €74 million (there was a profit of €337 million for Q4 2012, IAS 19 restated). The €411 million decrease reflected the €351 million decrease in EBIT and higher net financial expense.

Income taxes were a positive €1,370 million, including a positive one-off €1,500 million from the recognition of net deferred tax assets related to Chrysler. Net of this item, income taxes were a cost of €130 million (€113 million for Q4 2012). For Fiat ex- Chrysler there was a positive €16 million.

Net profit was €1,296 million (€224 million for Q4 2012, IAS 19 restated), of which €860 million was attributable to owners of the parent (compared with €7 million for Q4 2012). Excluding unusual items and the positive deferred tax impact, net profit was €252 million (€336 million for Q4 2012, IAS 19 restated). Fiat ex-Chrysler reported a net loss excluding unusuals of €235 million (€123 million loss in Q4 2012).

Net industrial debt at 31 December 2013 was €6.6 billion, a €1.7 billion decrease from September-end. A cash flow from operations of €2.2 billion (€1.7 billion in Q4 2012) and a net reduction in working capital of €1.7 billion (€0.6 billion in Q4 2012) more than offset capital expenditure of €2.2 billion for the quarter (€2.3 billion in Q4 2012). Chrysler contributed strong cash generation for the fourth quarter, with positive net cash flow of €1.4 billion, ending the year with a net cash position. Fiat ex-Chrysler reduced its net debt position by €0.3 billion, with €1.3 billion of capital expenditure (+18% over Q4 2012) more than offset by the positive contribution of both cash flow from operations and working capital, which benefited from the favorable Q4 seasonality.

Total available liquidity of €22.7 billion, increased €2.6 billion during the quarter, equally supported by a strong net industrial cash flow and the positive contribution from financing activities, including a new bond issuance of CHF 450 million. There was a negative currency translation impact of €0.4 billion for the quarter. For Fiat ex-Chrysler, total available liquidity was €12.1 billion (€10.7 billion at September-end) and for Chrysler €10.6 billion (€9.5 billion at September-end).

[1] The UAW Retiree Medical Benefits Trust, a Voluntary Employees’ Beneficiary Association, is an independently administered trust established to pay health care benefits for retirees from Chrysler.

[2] The UAW Retiree Medical Benefits Trust, a Voluntary Employees’ Beneficiary Association, is an independently administered trust established to pay health care benefits for retirees from Chrysler.

Dividends

The Board of Directors, pending approval of Fiat S.p.A.’s 2013 financial statements on 27 February 2014, has decided not to recommend a dividend payment on Fiat shares, given the Company’s desire to maintain a balanced level of liquidity following the acquisition of the minority stake in Chrysler Group LLC.

| FIAT GROUP | |||||||||||||

| Income Statement – Full Year | |||||||||||||

| 2013 | 2012 (*) | ||||||||||||

| (€ million) | Fiat (A) |

Fiat ex Chrysler |

Fiat (B) |

Fiat ex Chrysler |

Change (A vs B) |

||||||||

| Net revenues | 86,816 | 35,593 | 83,957 | 35,566 | 2,859 | ||||||||

| Trading profit | 3,394 | 246 | 3,541 | 338 | -147 | ||||||||

| EBIT | 2,972 | (188) | 3,404 | 187 | -432 | ||||||||

| EBITDA (1) | 7,546 | 2,113 | 7,538 | 2,304 | 8 | ||||||||

| EBITDA ex-unusuals | 8,065 | 2,650 | 7,782 | 2,565 | 283 | ||||||||

| Profit/(loss) before taxes | 1,008 | (1,177) | 1,519 | (630) | -511 | ||||||||

| Net Profit/(loss) | 1,951 | (441) | 896 | (1,048) | 1,055 | ||||||||

| Net Profit/(loss) ex-unusuals (2) | 943 | (911) | 1,140 | (787) | -197 | ||||||||

| (*) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €273 million (€17 million for Fiat ex Chrysler), Profit before Taxes reduced by €517 million (€9 million higher loss for Fiat ex Chrysler), Net Profit reduced by €515 million (€7 million higher loss for Fiat ex Chrysler).

(1) EBIT plus Depreciation and Amortization. (2) Excluding net unusual charges and one-off net deferred tax assets. |

|||||||||||||

| FIAT GROUP | |||||||||||||

| Income Statement – 4th Quarter | |||||||||||||

| 2013 | 2012 (*) | ||||||||||||

| (€ million) | Fiat (A) |

Fiat ex Chrysler |

Fiat (B) |

Fiat ex Chrysler |

Change (A vs B) |

||||||||

| Net revenues | 24,001 | 9,216 | 21,775 | 9,151 | 2,226 | ||||||||

| Trading profit | 931 | 69 | 887 | 109 | 44 | ||||||||

| EBIT | 456 | (407) | 807 | 26 | -351 | ||||||||

| EBITDA (1) | 1,684 | 199 | 1,836 | 556 | -152 | ||||||||

| EBITDA ex-unusuals | 2,167 | 683 | 1,948 | 673 | 219 | ||||||||

| Profit/(loss) before taxes | (74) | (708) | 337 | (185) | -411 | ||||||||

| Net Profit/(loss) | 1,296 | 288 | 224 | (240) | 1,072 | ||||||||

| Net Profit/(loss) ex-unusuals (2) | 252 | (235) | 336 | (123) | -84 | ||||||||

| (*) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €100 million (€3 million for Fiat ex Chrysler), Profit before Taxes reduced by €166 million (€1 million higher loss for Fiat ex Chrysler), Net Profit reduced by €164 million (€1 million lower loss for Fiat ex Chrysler).

(1) EBIT plus Depreciation and Amortization. (2) Excluding net unusual charges and one-off net deferred tax assets. |

|||||||||||||

| FIAT GROUP | |||||||||||||||||||

| Net Debt and Total Available Liquidity | |||||||||||||||||||

| 31.12.2013 | 30.09.2013 | 31.12.2012 | |||||||||||||||||

| (€ million) | Fiat | Chrysler | Fiat ex- Chrysler |

Fiat | Chrysler | Fiat ex- Chrysler |

Fiat | Chrysler | Fiat ex- Chrysler |

||||||||||

| Cash Maturities (Principal) | (28,678) | (9,378) | (19,300) | (28,027) | (9,646) | (18,381) | (26,727) | (10,093) | (16,634) | ||||||||||

| Bank Debt | (8,754) | (2,540) | (6,214) | (8,377) | (2,607) | (5,770) | (8,189) | (2,702) | (5,487) | ||||||||||

| Capital Market (1) | (14,220) | (2,320) | (11,900) | (13,818) | (2,369) | (11,449) | (12,361) | (2,425) | (9,936) | ||||||||||

| Other Debt (2) | (5,704) | (4,518) | (1,186) | (5,832) | (4,670) | (1,162) | (6,177) | (4,966) | (1,211) | ||||||||||

| Asset-backed financing (3) | (596) | – | (596) | (395) | – | (395) | (449) | – | (449) | ||||||||||

| Accruals and other adjustments (4) | (601) | (159) | (442) | (468) | (122) | (346) | (655) | (210) | (445) | ||||||||||

| Gross Debt | (29,875) | (9,537) | (20,338) | (28,890) | (9,768) | (19,122) | (27,831) | (10,303) | (17,528) | ||||||||||

| Cash & Marketable Securities | 19.686 | 9,676 | 10,010 | 17,076 | 8,508 | 8,568 | 17,913 | 8,803 | 9,110 | ||||||||||

| Derivatives Assets/(Liabilities) | 396 | 76 | 320 | 409 | 70 | 339 | 318 | 3 | 315 | ||||||||||

| (Net Debt)/Net Cash | (9,793) | 215 | (10,008) | (11,405) | (1,190) | (10,215) | (9,600) | (1,497) | (8,103) | ||||||||||

| Industrial Activities | (6,649) | 215 | (6,864) | (8,307) | (1,190) | (7,117) | (6,545) | (1,497) | (5,048) | ||||||||||

| Financial Services | (3,144) | – | (3,144) | (3,098) | – | (3,098) | (3,055) | – | (3,055) | ||||||||||

| Undrawn committed credit lines | 3,043 | 943 | 2,100 | 3,063 | 963 | 2,100 | 2,935 | 985 | 1,950 | ||||||||||

| Total available liquidity | 22,729 | 10,619 | 12,110 | 20,139 | 9,471 | 10,668 | 20,848 | 9,788 | 11,060 | ||||||||||

| (1) Includes bonds and other securities issued in the financial markets.

(2) Includes VEBA Notes, HCT Notes, IFRIC 4 and other non-bank financing. (3) Advances on sale of receivable and securitization on book. (4) 31 December 2013 Includes: adjustments for hedge accounting on financial payables negative for €78 million (-€84 million as of 30 September 2013, -€111 million as of 31 December 2012), current financial receivables from jointly controlled financial service companies of €27 million (€94 million as of 30 September 2013, €58 million as of 31 December 2012) and (accrued)/unearned net financial charges for an amount of €550 million (€478 million as of 30 September 2013, €602 million as of 31 December 2012). |

|||||||||||||||||||

Results by Segment

Full Year

| FIAT GROUP Revenues and EBIT by Segment – Full Year |

| Revenues | EBIT | ||||||||

| 2013 | 2012 | Change | (€ million) | 2013 | 2012 (1) | Change | |||

| 45,777 | 43,521 | 2,256 | NAFTA (mass-market brands) | 2,290 | 2,491 | -201 | |||

| 9,973 | 11,062 | -1,089 | LATAM (mass-market brands) | 492 | 1,025 | -533 | |||

| 4,621 | 3,128 | 1,493 | APAC (mass-market brands) | 318 | 255 | 63 | |||

| 17,420 | 17,800 | -380 | EMEA (mass-market brands) | (520) | (737) | 217 | |||

| 3,809 | 2,898 | 911 | Luxury Brands (Ferrari, Maserati) | 470 | 392 | 78 | |||

| 8,080 | 8,030 | 50 | Components (Magneti Marelli, Teksid, Comau) | 146 | 165 | -19 | |||

| 929 | 979 | -50 | Other | (167) | (149) | -18 | |||

| (3,793) | (3,461) | -332 | Eliminations and adj. | (57) | (38) | -19 | |||

| 86,816 | 83,957 | 2,859 | Total | 2,972 | 3,404 | -432 | |||

| (1) Restated for adoption of IAS 19 as amended: EBIT reduced by €250 million for NAFTA, €7 million for LATAM,€2 million for Components and €15 million for Eliminations and Adjustments. For EMEA, loss reduced by €1 million. | |||||||||

Fourth Quarter

| FIAT GROUP Revenues and EBIT by Segment – 4th Quarter |

| Revenues | EBIT (1) | ||||||||

| 2013 | 2012 | Change | (€ million) | 2013 | 2012(1) | Change | |||

| 13,303 | 11,408 | 1,895 | NAFTA (mass-market brands) | 621 | 561 | 60 | |||

| 2,220 | 2,896 | -676 | LATAM (mass-market brands) | (28) | 242 | -270 | |||

| 1,331 | 821 | 510 | APAC (mass-market brands) | 48 | 36 | 12 | |||

| 4,430 | 4,552 | -122 | EMEA (mass-market brands) | (216) | (164) | -52 | |||

| 1,318 | 793 | 525 | Luxury Brands (Ferrari, Maserati) | 158 | 128 | 30 | |||

| 2,148 | 2,042 | 106 | Components (Magneti Marelli, Teksid, Comau) | 14 | 47 | -33 | |||

| 244 | 267 | -23 | Other | (66) | (40) | -26 | |||

| (993) | (1,004) | 11 | Eliminations and adj. | (75) | (3) | -72 | |||

| 24,001 | 21,775 | 2,226 | Total | 456 | 807 | -351 | |||

| (1) Restated for adoption of IAS 19 as amended: EBIT reduced by €91 million for NAFTA, €7 million for LATAM, €4 million for Eliminations and Adjustments and increased by €1 million for Components For EMEA, loss reduced by €1 million. | |||||||||

MASS-MARKET BRANDS

NAFTA

Full Year

| NAFTA Full Year |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 45,777 | 43,521 | 2,256 | ||

| Trading profit | 2,220 | 2,443 | -223 | ||

| EBIT | 2,290 | 2,491 | -201 | ||

| Shipments (in 000s) | 2,238 | 2,115 | 123 | ||

| (1) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €250 million. | |||||

Vehicle shipments in NAFTA totaled 2,238,000 units for FY 2013, representing a 6% increase over FY 2012. In the U.S., vehicle shipments were 1,876,000 (up 7% from FY 2012), in Canada 269,000 (up 5%) and 93,000 for Mexico and other. The year benefited from strong shipments and sales of the Ram 1500 pickup truck, Jeep Grand Cherokee and Wrangler and, from Q4, the very positive market reception of the all-new Jeep Cherokee.

Vehicle sales[3] in NAFTA totaled 2,147,000 for FY 2013, an increase of 8% over FY 2012. Sales increased 9% in the U.S. to 1,800,000 units and 7% in Canada to 260,000. In the U.S., the Group has posted 45 consecutive months of year-over-year sales gains and the strongest annual sales since 2007. In Canada, the Group recorded its 49th consecutive month of year-over-year sales growth in December and, for the full year, it reconfirmed its position as the number two selling manufacturer, posting the strongest annual sales level since 2000.

The U.S. vehicle market finished FY 2013 up 7% year-over-year to 15.9 million vehicles. The Group’s overall market share was up 0.2 p.p. versus the prior year to 11.4%. Jeep vehicle sales totaled 490,000 for the year, up 3% versus FY 2012, with double-digit percentage increases for all currently produced vehicles, including the Jeep Grand Cherokee (+13%), Jeep Compass (+32%), Jeep Patriot (+22%) and the Jeep Wrangler (+10%), offsetting the absence of Jeep Liberty sales for most of 2013 (6,000 in 2013 compared to 75,000 in 2012). The Liberty replacement, the all-new Jeep Cherokee was first delivered to U.S. dealers at the end of October 2013, and 26,000 have already been sold to consumers in Q4. Dodge, the Group’s number one selling brand in the region, posted sales of 596,000 vehicles, up 14% from the prior year mainly driven by the Charger (+19%), Durango (+43%), and Challenger (+19%), as well as the first full-year contribution of the Dart with 83,000 units. The Ram truck brand posted an increase of 22% to 368,000 vehicles, the largest increase of all brands, with sales increases for light-duty and heavy-duty pickups of 25% and 16%, respectively. Chrysler brand sales totaled 303,000 vehicles during FY 2013, down slightly from last year.

The Canadian vehicle market increased 4% year-over-year to 1.78 million vehicles. The Group’s total market share increased 0.4 p.p. versus FY 2012 to 14.6%, mainly driven by strong performances from the Ram light-duty pickup (+25% year-over-year), Dodge Dart (+185%) and Chrysler Town & Country (+111%).

Fiat brand sales in the U.S. and Canada were down 2% year-over-year to 51,000 vehicles for FY 2013. The new 500L launched in May with sales of over 8,000 vehicles for the year.

NAFTA revenues were up 5% over the prior year to €45.8 billion, +9% at constant exchange rates.

Trading profit for FY 2013 was €2,220 million (€2,443 million for FY 2012, IAS 19 restated), with positive volume and pricing impacts more than offset by higher industrial costs, including costs associated with new models and content enhancements, in addition to negative currency translation impacts (~€80 million) and higher R&D amortization.

EBIT was €2,290 million (€2,491 million for FY 2012, IAS 19 restated), mainly reflecting lower trading profit and €23 million higher net unusual income. For 2013, net unusual income of €71 million included a gain of €166 million, with a corresponding net reduction to the pension obligation following amendments to Chrysler’s U.S. and Canadian salaried defined benefit pension plans, partly offset by charges related to the June 2013 voluntary safety recall for the 1993-1998 Jeep Grand Cherokee and the 2002-2007 Jeep Liberty, as well as the customer satisfaction action for the 1999-2004 Jeep Grand Cherokee.

Throughout the year, the Group’s products received various awards and recognitions, including the Ram Pickup, which received back-to-back Motor Trend Magazine’s “Truck of the Year” for 2013 and 2014, the first time ever a vehicle has won two years in a row. The 2013 Ram Pickup also won the “North American Truck/Utility of the Year” at the North American Auto Show in January 2013. The 3.0-liter EcoDiesel V-6 and the Fiat 500e battery-electric drive system were named among Ward’s “10 Best Engines for 2014”. In addition, the Group won 15 of 24 awards issued by the Texas Auto Writers Association, including the Truck of Texas (Ram 1500 pickup), SUV of Texas (Jeep Grand Cherokee), Commercial Vehicle of Texas (Ram ProMaster), and Truck Line of Texas (Ram Trucks).

Quality awards garnered throughout the year included the 2013 Chrysler 200 Convertible, Chrysler Town & Country, Dodge Durango, and Dodge Dart being named “Best 2013 Total Quality” in their respective segments by Strategic Vision’s Total Quality Index. The Chrysler Town & Country was judged the “Highest-Ranking Minivan” by the J.D. Power 2013 Initial Quality Study. Various vehicles also continue to be recognized as “Top Safety Picks” by the Insurance Institute for Highway Safety, and Consumer Digest and Consumer Guide® “Best Buys”.

[3]“Sales” represents sales to end customers as reported by the Chrysler dealer network.

Fourth Quarter

| NAFTA 4th Quarter |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 13,303 | 11,408 | 1,895 | ||

| Trading profit | 620 | 555 | 65 | ||

| EBIT | 621 | 561 | 60 | ||

| Shipments (in 000s) | 651 | 543 | 108 | ||

| (1) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €91 million. | |||||

Vehicle shipments in NAFTA totaled 651,000 units for Q4 2013, a 20% increase over the same period in 2012, boosted by the start of shipments of the all-new Jeep Cherokee to dealers in October. In the U.S., vehicle shipments were 562,000 (up 23% over Q4 2012), in Canada 61,000 (up 12%). Shipments for Mexico and other were 28,000.

Vehicle sales in NAFTA totaled 521,000 for the period, an increase of 9% over Q4 2012. Sales increased 11% in the U.S. to 443,000. In Canada, sales increased 7% to 53,000 vehicles, and vehicle sales in Mexico were 25,000.

The U.S. vehicle market for Q4 2013 was up 6% year-over-year to 3.9 million vehicles. Overall market share was 11.4% for the quarter, compared to 10.9% for the same period in 2012. Jeep sales totaled 135,000 vehicles for the period, up 24% year-over-year, primarily driven by increases for the Compass and the Patriot, as well as the contribution from the all-new Jeep Cherokee. Dodge posted a 1% increase in sales to 134,000 vehicles in Q4, with the Charger and Dart contributing increases of 31% and 9%, respectively, versus the same period last year. The Ram brand posted a sales increase of 21% to 99,000 vehicles. Chrysler brand sales totaled 65,000 vehicles for the quarter, down 3% year-over-year.

The Canadian vehicle market grew 6% year-over-year to 401,000 vehicles. Total market share was 13.2% for Q4 2013, up 0.2 p.p. from the same period in 2012.

The NAFTA region reported revenues of €13.3 billion for Q4 2013, up 17% (CER +22%) over the same period last year primarily due to higher volumes.

Trading profit was €620 million for the quarter, a €65 million increase over Q4 2012 (IAS 19 restated), driven primarily by higher volumes, mix and pricing, partially offset by higher industrial costs, including costs associated with new models and content enhancements.

EBIT was €621 million, an 11% increase over Q4 2012 (IAS 19 restated), reflecting the trading profit performance for the period.

| LATAM Full Year |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 9,973 | 11,062 | -1,089 | ||

| Trading profit | 619 | 1,056 | -437 | ||

| EBIT | 492 | 1,025 | -533 | ||

| Shipments (in 000s) | 950 | 979 | -29 | ||

| (1) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €7 million. | |||||

In 2013, Group shipments in the LATAM region decreased 3% year-over-year to a total of 950,000 vehicles. Industry sales in LATAM were up 1.3% to 5,924,000 units.

In Brazil, the passenger car and LCV market was down 1.5% over the prior year to 3,581,000 units.

For 2013, the Group confirmed its leadership in the Brazilian market, with an overall share of 21.5%, 1.8 p.p. lower than 2012, when exceptional performance was driven by the Group’s flexibility in responding to the sharp increase in demand following the government’s introduction of incentives, but still 2.7 p.p. ahead of the nearest competitor. Group products continued to perform well, taking a combined 25% share of the A/B segment, driven by the continued success of the new Palio and Uno. Siena and Grand Siena posted a combined 25% year-over-year increase and Strada was up 5% (50% segment share) boosted by the contribution from the refreshed model launched in Q4.

The Group shipped 785,000 passenger cars and LCVs in Brazil, representing a 7% decrease compared with 2012, which benefited from a period of higher sales tax incentives.

In Argentina, where the market was up 14% for the year to 919,000 units, Group sales increased 31% to approximately 111,000 units, with share up 1.4 p.p. to 12.0% facilitated by improved customs clearance for vehicle imports. In the A/B segment, share was 14.1%, with the Palio posting a 71% year-over-year increase.

For other LATAM markets, shipments totaled approximately 54,000 units, up 7% over 2012.

Revenues for the region totaled approximately €10 billion, a decrease of 10% over 2012 (CER +1%).

Trading profit was €619 million (€1,056 million for 2012). Net of negative currency translation effects (€85 million), the decrease was mainly attributable to Brazilian operations due to input cost inflation, also due to the weakening of the Real affecting prices of imported materials, unfavorable production mix and lower volumes, as well as initial start-up costs for the Pernambuco plant. Venezuela trading performance was down mainly due to reduced volumes and negative mix as foreign exchange restrictions limited supply levels, while the other LATAM markets improved.

EBIT was €492 million (€1,025 million in 2012), reflecting the lower trading profit and net unusual charges of €127 million, mainly related to the negative impact of the February 2013 devaluation of the Venezuelan bolivar (VEF) relative to the U.S. dollar (net €43 million) and to the streamlining of architectures and models associated with the region’s refocused product strategy (€75 million).

During the year, new product launches included: the 2014 Fiat Uno and Dodge Durango in Q1; special versions of the Fiat Grand Siena and Strada in Q2; special Italia series versions of the new Fiat Uno and Palio Fire in Q3; and, in Q4, the new Fiat Fiorino and Strada, the 2014 Jeep Grand Cherokee, and the Grazie Mille special edition of the Fiat Uno Mille.

The new Strada was the winner of four categories in the Truck of the Year 2013 awards from Auto Esportemagazine. The Grand Siena won Owners Satisfaction Award 2013 in its segment from Quatro Rodasmagazine.

The Group’s new plant in Goiana, Pernambuco, is expected to start activities during the first half of 2015 with initial production capacity of 200,000 vehicles per year based on the Small Wide platform which will strengthen the product offering in the mid-size segments of the market. The site will also have an integrated supply park, product engineering center and testing facilities.

Fourth Quarter

| LATAM 4th Quarter |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 2,220 | 2,896 | -676 | ||

| Trading profit | 44 | 242 | -198 | ||

| EBIT | (28) | 242 | -270 | ||

| Shipments (in 000s) | 227 | 267 | -40 | ||

| (1) Restated for adoption of IAS 19 as amended: Trading Profit/EBIT reduced by €7 million. | |||||

In the fourth quarter, shipments in the LATAM region were down 15% to 227,000 units.

In Brazil, the passenger car and LCV market was down 3% year-over-year to 939,000 units, with Group market share at 20%. Fiat models held a combined 23.1% share of the A and B segments and 46.5% of the light pickup segment.

Group sales of passenger cars and LCVs in Brazil, as well as shipments, totaled 188,000 units during the fourth quarter, representing an 18% decline over Q4 2012. That performance compared with an exceptionally strong Q4 2012, which reflected the Group’s flexibility in reacting to increased demand in the Brazilian market driven by government sales tax incentives.

In Argentina, where the market was up 23% to 193,000 units, the Group sold approximately 20,000 units. Share for the period was up 1.2 p.p. to 10.5%. Shipments increased by 14% to 24,000 vehicles.

In other LATAM countries, shipments were in line with the prior year at approximately 15,000 units.

Revenues totaled €2.2 billion, a 23% decrease in nominal terms (CER -13%), mainly reflecting the volume trend.

Trading profit for the period was €44 million, down €198 million from Q4 2012. Net of negative currency translation effects (€13 million), the decrease was mainly attributable to input cost inflation and reduced volumes in Brazil and to Venezuela where reduced volumes and a less favorable mix impacted negatively.

EBIT was a negative €28 million (positive €242 million in Q4 2012), reflecting lower trading profit and €72 million in unusual charges, related to the streamlining of architectures and models associated with the region’s refocused product strategy.

| APAC Full Year |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 4,621 | 3,128 | 1,493 | ||

| Trading profit | 358 | 260 | 98 | ||

| EBIT | 318 | 255 | 63 | ||

| Shipments (in 000s) (*) | 163 | 103 | 60 | ||

| (*) Consolidated shipments, excluding JV’s. | |||||

Vehicle shipments in APAC (excluding JVs) totaled 163,000 units for 2013, representing an increase of 58% over the prior year.

Regional demand[4] rose year-over-year led by growth in China and Australia, while India and South Korea were down versus the prior year.

Group retail sales, including JVs, totaled 199,500 units, up 73% over the prior year driven by strong performance in China and Australia, compared with a 9% growth for the industry. By brand, Jeep sales were up 26% versus the prior year. Fiat brand posted growth of 40,700 units for the year, reflecting sales performance for the Chinese-produced Fiat Viaggio launched in late 2012. Dodge brand sales were up 5 times over the prior year, driven by the re-launch of the Dodge Journey in China in early 2013.

Revenues for the region totaled €4.6 billion, an increase of 48% (CER +54%) versus 2012.

Trading profit was €358 million, up €98 million over the prior year with strong volume growth, partially offset by higher industrial and SG&A expenses to support Group growth in the region, as well as unfavorable currency translation effects.

EBIT was €318 million, up 25% compared with €255 million in 2012, with higher trading profit partially offset by losses in the Chinese joint ventures due to industrial costs related to new product launches.

Jeep remained the best-selling brand across the region and, during the year, the product line-up was enhanced with the introduction of the new 2014 Grand Cherokee with 8-speed automatic transmission and 3.0L variants of the Jeep Grand Cherokee and Jeep Wrangler.

Launched in February 2013 with new and improved features, the Dodge Journey enjoyed a successful return, quickly becoming the Group’s fourth best-selling vehicle in the region and driving the brand’s five-fold sales increase for the year.

Fiat Viaggio continued to gain momentum in China, becoming the Group’s best-selling vehicle in the region. The Fiat brand product line-up was further enhanced with the presentation of the Shining Edition of the Fiat Viaggio and the all-new hatchback version, the Fiat Ottimo, both unveiled at the Guangzhou Auto Show in November. The second Fiat vehicle to be produced in China, the Fiat Ottimo will be launched at dealerships in early 2014.

The newly-established distribution network in India which now totals 100 points of sale, posted a 41% same period year-over-year sales increase since its inception in April 2013, driven by the successful launch of the all-new Fiat Linea Classic and Fiat Punto Sport in Q3 2013.

In other key markets, Group sales in Australia grew 53% year-over-year, compared with 2% for the industry, representing the best year-over-year growth in the market by any manufacturer and driven by the Jeep and Fiat brands. In South Korea, Group sales were up 16% over the prior year driven by the re-introduction of the Fiat brand. In Japan, sales were up 6% year-over-year compared with a flat performance for the industry.

[4] Aggregate for key markets where the Group is present (i.e. China, India, Australia, Japan and South Korea).

Fourth Quarter

| APAC 4th Quarter |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 1,331 | 821 | 510 | ||

| Trading profit | 63 | 46 | 17 | ||

| EBIT | 48 | 36 | 12 | ||

| Shipments (in 000s) (*) | 48 | 26 | 22 | ||

| (*) Consolidated shipments, excluding JV’s. | |||||

Vehicle shipments in APAC (excluding JVs) totaled 48,000 units for Q4 2013, representing an increase of 85% over Q4 2012. Group retail sales, including JVs, totaled 62,000 units for the period, up 79% over the prior year – compared to 15% for the industry – driven by strong performance in China and Australia.

Revenues for the region totaled €1,331 million, representing an increase of 62% over Q4 2012.

Trading profit totaled €63 million, a 37% increase over €46 million for Q4 2012, with strong volume growth only partially offset by higher industrial costs and expenses related to development in the region, as well as unfavorable currency translation effects.

EBIT was €48 million, representing an increase of 33% over the same period last year.

| EMEA Full Year |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 17,420 | 17,800 | -380 | ||

| Trading profit | (470) | (703) | 233 | ||

| EBIT | (520) | (737) | 217 | ||

| Shipments (in 000s) | 979 | 1,012 | -33 | ||

| (1) Restated for adoption of IAS 19 as amended: Trading loss and negative EBIT reduced by €1 million. | |||||

Passenger car and LCV shipments in the EMEA region totaled 979,000 units for the year, a decrease of approximately 33,000 units (-3%) over 2012.

Passenger car shipments were down 4% to 776,000 units, with significant declines in Italy and Germany, and LCV shipments were in line with the prior year at 203,000 units.

In Europe (EU27+EFTA), the passenger car market was down 2% for the year to 12.3 million vehicles. By major market, demand was down in Italy (-7%), France (-6%) and Germany (-4%). The positive trend continued in both the U.K. and Spain, where demand was up 11% and 3%, respectively. For the rest of Europe, there was an overall contraction of around 4%.

Group brands accounted for a combined 6.0% share of the European market, representing a 0.3 p.p. decrease over 2012. There were year-over-year gains in France (+0.2 p.p. to 3.5%), Spain (+0.4 p.p. to 3.7%) and U.K. (+0.1 p.p. to 3.2%). By contrast, share was down 0.9 p.p. in Italy to 28.7% and 0.2 p.p. in Germany to 2.7%, in part reflecting management of channel mix.

The commercial strategy centered on the 500 family continues to yield positive results. The 500 was the best selling A-segment vehicle in Europe, with a 13.9% share, and the 500L ranked as the number one Small MPV, with 73,500 units sold for the year and a 17.9% segment share.

The European light commercial vehicle market (EU27+EFTA) registered a 1% year-over-year decrease, with significant contractions in Italy (-15%), France (-5%) and Germany (-2%).

Fiat Professional’s European share[5] was down marginally to 11.6% as a result of a less favorable market mix. Share was up 1.3 p.p. in Italy to 44.0%, up 1.4 p.p. in the U.K. to 5.0% and up 0.4 p.p. in Spain to 8.9%. In France and Germany, share remained in line with prior year levels at 9.0% and 11.7%, respectively.

EMEA closed 2013 with revenues of €17.4 billion, a year-over-year decrease of 2% mainly attributable to lower volumes.

The trading loss of €470 million for the year showed an improvement of €233 million or 33% over the €703 million loss recorded in 2012, with better product mix (driven primarily by results for the 500 family) and efficiencies in selling and input costs more than offsetting negative net pricing and volumes and higher R&D amortization.

EBIT was a negative €520 million, an improvement over the prior year’s level (-€737 million), mainly reflecting improved trading profit and lower contribution from equity investments (€145 million in 2013 and €160 million in 2012) with unusual charges flat at €195 million and including for 2013 the write-off of previously capitalized R&D related to new model development for Alfa Romeo products which have now been switched to a new platform considered technically more appropriate for the brand.

During the year, new product highlights included: the launch of the 105 hp 1.6L MultiJet II and 0.9L TwinAir Turbo engine versions of the 500L, as well as the new Fiat 500L Living and Trekking and the “Natural Power” versions of the 500L and 500L Living. In the fourth quarter, the brand also introduced the 105 hp 0.9L TwinAir option for the 500 and 500C and the 120 hp 1.4L T-Jet Turbo and 1.6L MultiJet II options for the 500L, 500L Trekking and 500L Living. At the Frankfurt Motor Show in September, Fiat presented the special 30thanniversary limited edition Panda 4×4 Antarctica. The Fiat brand received the “Best Green Engine of the Year 2013” award for the eco-performing natural gas TwinAir Turbo.

In October, Alfa Romeo presented refreshed versions of the MiTo and Giulietta, with new engine options, including the 105 hp 0.9L TwinAir Turbo for the MiTo and the all-new 150 hp 2.0 JTDM 2 for the Giulietta, as well as latest generation UConnect infotainment systems and new interiors.

The brand also began delivery of the “Launch Edition” of the Alfa Romeo 4C in the fourth quarter. The Alfa Romeo 4C was named winner of the Sportscars/Imported category by readers of Auto Zeitung in Germany and was named “Car of the Year 2013” by FHM magazine in the U.K.

Jeep launched the 2014 Jeep Grand Cherokee in markets across Europe during Q2 followed, in the fourth quarter, by the 2014 Jeep Compass, which has undergone a refresh.

During the year, the World Class Manufacturing program’s Gold level was awarded to Fiat plants in Pomigliano d’Arco, Italy, and Tychy, Poland, as well as the Tofaş plant in Bursa, Turkey.

[5]Due to unavailability of market data for Italy since January 2011, the figures reported are an extrapolation and discrepancies with actual data could exist.

Fourth Quarter

| EMEA 4th Quarter |

| (€ million) | 2013 | 2012 (1) | change | ||

| Net revenues | 4,430 | 4,552 | -122 | ||

| Trading profit | (50) | (120) | 70 | ||

| EBIT | (216) | (164) | -52 | ||

| Shipments (in 000s) | 236 | 248 | -12 | ||

| (1) Restated for adoption of IAS 19 as amended: Trading loss and negative EBIT reduced by €1 million. | |||||

During the fourth quarter, the Group shipped a total of 236,000 passenger cars and LCVs in EMEA, a decrease of approximately 12,000 units (-5%) over the same period in 2012.

Passenger car shipments were down 7% to 180,000 units and LCV shipments remained substantially unchanged versus Q4 2012 at 56,000 units.

In Europe (EU27+EFTA) the passenger car market grew 6% to 3 million vehicles. For the major markets, the positive trend continued in the U.K., which was up 11% year-over-year, and Spain posted a 22% increase, reflecting the positive impact of domestic incentive schemes. Germany and France were also higher, with increases of 2% and 3%, respectively. The negative demand trend continued in Italy, however, with demand down 3% over the prior year. For the rest of Europe, demand was up 10% overall.

| LUXURY BRANDS Ferrari, Maserati – Full Year |

| (€ million) | 2013 | 2012(1) | change | |||

| Ferrari | ||||||

| Shipments (000s) | 7.0 | 7.4 | -0.4 | |||

| Net revenues | 2,335 | 2,225 | 110 | |||

| Trading profit | 364 | 335 | 29 | |||

| EBIT | 364 | 335 | 29 | |||

| Maserati | ||||||

| Shipments (000s) | 15.4 | 6.2 | 9.2 | |||

| Net revenues | 1,659 | 755 | 904 | |||

| Trading profit | 171 | 57 | 114 | |||

| EBIT | 106 | 57 | 49 | |||

| LUXURY BRANDS | ||||||

| Shipments (000s) | 22.4 | 13.6 | 8.8 | |||

| Net revenues (*) | 3,809 | 2,898 | 911 | |||

| Trading profit | 535 | 392 | 143 | |||

| EBIT | 470 | 392 | 78 | |||

| LUXURY BRANDS Ferrari, Maserati – 4th Quarter |

| (€ million) | 2013 | 2012 (1) | change | |||

| Ferrari | ||||||

| Shipments (000s) | 1.7 | 2.1 | -0.4 | |||

| Net revenues | 624 | 621 | 3 | |||

| Trading profit | 100 | 115 | -15 | |||

| EBIT | 100 | 115 | -15 | |||

| Maserati | ||||||

| Shipments (000s) | 7.9 | 1.6 | 6.3 | |||

| Net revenues | 776 | 196 | 580 | |||

| Trading profit | 123 | 13 | 110 | |||

| EBIT | 58 | 13 | 45 | |||

| LUXURY BRANDS | ||||||

| Shipments (000s) | 9.6 | 3.7 | 5.9 | |||

| Net revenues (*) | 1,318 | 793 | 525 | |||

| Trading profit | 223 | 128 | 95 | |||

| EBIT | 158 | 128 | 30 | |||

| (1) Ferrari and Maserati stand-alone have been restated to reflect the allocation to Maserati of its activities in China conducted, from a legal entity standpoint, through the local Ferrari subsidiary.

(*) Net of eliminations. |

||||||

Group brands recorded a combined 5.6% share of the European market for the quarter, down 0.6 p.p. over Q4 2012, reflecting lower market share in the Italian market which also decreased its overall weighting in Europe.

In Italy, market share was down 1.6 p.p. over Q4 2012 to 27.7%, which in part reflected the Group’s decision not to engage in value destructive price competition. Share was slightly higher in Spain (+0.1 p.p. to 3.3%) and the U.K. (+0.2 p.p. to 3.2%), but down 0.1 p.p. in France to 3.3% and 0.2 p.p. in Germany to 2.5%.

The European light commercial vehicle market (EU27+EFTA) registered a 9% increase over Q4 2012 to 414,000 units. In Italy, the LCV market was down 2% for the quarter.

Fiat Professional closed the quarter with European share down 0.4 p.p. to 10.4%. In Italy, however, share was up 3.3 p.p. on the prior year to 46%.

EMEA closed the quarter with revenues of €4.4 billion, representing a modest decrease over Q4 2012. The trading performance improved by €70 million, with a trading loss of €50 million for the quarter. The improvement was primarily attributable to the improved product mix and cost efficiencies.

EBIT was a negative €216 million (negative €164 million in Q4 2012), which included €194 million in unusual charges (€80 million in Q4 2012).

LUXURY BRANDS

Ferrari

Consistent with the 2013 announcement that production would be maintained below the prior year’s level to preserve the brand’s exclusivity, Ferrari managed shipments to the network down to 6,922 street cars (-5% vs. 2012), including the first 20 units of the special edition “LaFerrari”. Shipments of 8-cylinder models were down 12% over the prior year, but there was a 19% increase for 12-cylinder models attributable primarily to sales of the F12 Berlinetta released just one year ago.

North America remained Ferrari’s number 1 market with 2,242 street cars shipped during the year (+9% vs. 2012), accounting for 32% of total sales (28% in 2012). In Europe, volumes in the UK were in line with the prior year, but down in other major markets. Middle East posted 11% growth. In the Far East, the decrease in shipments in the China-Hong Kong-Taiwan market was partially offset by an increase in Japan.

Ferrari reported 2013 revenues of €2,335 million, an increase of 5% over the prior year.

Trading profit and EBIT totaled €364 million, up €29 million over the €335 million in 2012. Trading margin improved to 15.6% from 15.1%, reflecting a better sales mix and the contribution from licensing and the personalization program.

For the fourth quarter, Ferrari posted revenues of €624 million, in line with the same period in 2012.

Trading profit and EBIT totaled €100 million, a decrease of €15 million over Q4 2012, primarily attributable to lower sales volumes.

In 2013, Ferrari reconfirmed its leading position in the sector with a series of innovative new products and awards.

At the Geneva Motor Show, the press and public were given a first look at the limited series LaFerrari: the maximum expression of the brand’s excellence in technological innovation, performance, styling and driving emotion.

The Frankfurt Motor Show was the venue for the debut of the limited edition 458 Speciale, which is equipped with a series of unique technological innovations and design features characteristic of the brand. The car features an array of patented and/or world-first Ferrari technologies ranging from its engine and drivetrain to the vehicle’s active aerodynamics and electronic control systems.

Awards and recognitions received during the year included: “Best Performance Engine of the Year”, for the third consecutive year, for the 12-cylinder engine on the F12 Berlinetta and “Supercar of the Year” from Top Gear for the 458 Speciale.

Maserati

For 2013, Maserati posted a 148% increase in shipments to 15,400 vehicles, driven by the success of the new Quattroporte and Ghibli models launched during the year. For the Quattroporte, which was released in March, shipments totaled 7,800 units. For the Ghibli, a total of 2,900 units were shipped between launch in October and year end. At 31 December, order intake for the two new models totaled 13,000 units apiece. Combined shipments for the GranTurismo and GranCabrio were in line with 2012 at 4,700 units for the year.

All markets contributed positively to the significant year-over-year increase. The USA remained the brand’s number one market with shipments up 138% over the prior year to 6,900 units. China, the brand’s second largest market, recorded the highest percentage increase with shipments up 334% to 3,800 units. Even in Europe, where economic conditions remained difficult, shipments were up 133% to 2,500 units on the back of the contribution of the new models. Results were also strong for the Asia-Pacific region (excluding China) and the Middle East, which registered increases of 52% (1,300 vehicles) and 81% (750 vehicles), respectively.

Revenues totaled €1,659 million for the year, an increase of 120% over 2012.

Maserati closed 2013 with full-year trading profit of €171 million, or 10.3% margin, representing a €114 million increase over the prior year (€57 million in 2012).

EBIT, which included a €65 million write-down of previously capitalized R&D related to a new model the development of which has now been switched to a more technically advanced platform considered more appropriate for the Maserati brand, totaled €106 million. The year-over-year improvement reflected the significant increase in volumes.

Maserati’s fourth quarter revenues totaled €776 million, representing 47% of revenues for the full year and nearly four-times the Q4 2012 level, with a significant contribution from the newly-launched Ghibli.

Trading profit was €123 million for the quarter, an increase of €110 million over Q4 2012.

EBIT, which included the above mentioned unusual charge, was €58 million.

In January 2013, Maserati gave its world premiere presentation of both the V8 (530 hp) and V6 (410 hp) versions of the new Quattroporte at the North American International Auto Show in Detroit. At the Geneva Motor Show in early March, Maserati presented the 4-seat GranTurismo MC Stradale and, for the first time in Europe, the new Quattroporte. The Shanghai Motor Show in April was the chosen venue for the world premiere presentation of the new Maserati Ghibli. At the Frankfurt Motor Show in September, Maserati showcased the diesel version of the Quattroporte along with the Ermenegildo Zegna Limited Edition concept version, the first project in partnership with the premiere Italian fashion house. Mid-November saw the North American debut of the Ghibli at the Los Angeles Auto Show.

COMPONENTS

Magneti Marelli

For 2013, Magneti Marelli reported revenues up 3% over the prior year to €5,988 million. At constant exchange rates, there was a year-over-year increase of 6%.

For 2013, Magneti Marelli reported revenues up 3% over the prior year to €5,988 million. At constant exchange rates, there was a year-over-year increase of 6%.

The increase was primarily driven by performance in NAFTA and China. There was also a modest gain in Europe. In Brazil, at constant exchange rates, revenues were substantially stable year-over-year.

The Lighting business line posted a 12% increase in revenues on the back of performance in China and in NAFTA, with full-year contributions from several new products which were launched during the second half of 2012. For the Electronic Systems business line, revenues were up 7% primarily due to growth in sales of “telematic and body” products. For the Powertrain business line, at constant exchange rates, revenues were in line with the prior year. The After Market business line posted a 5% increase in revenues (CER +13%) with growth in Europe and Mercosur only partially offset by a decrease in NAFTA.

Trading profit totaled €166 million, compared with €141 million for 2012, with top-line growth only partially offset by higher costs associated with the launch of new products in NAFTA.

EBIT was €169 million, an increase of €38 million over the prior year reflecting higher trading profit and non-repeat of unusual charges in 2012.

For the fourth quarter, Magneti Marelli posted revenues of €1,533 million, up 3% over the €1,484 million for the same period in 2012 (CER +8%). The increase was primarily attributable to the contribution of new products launched in NAFTA during the second half of 2012 and growth in sales of “telematic and body” products. Revenues were also higher in Europe.

Trading profit was higher at €57 million (€46 million for Q4 2012) and EBIT improved to €60 million (€39 million in Q4 2012).

Teksid

The sector posted 2013 revenues of €688 million, down 12% over the prior year.

The Cast Iron business unit posted a 7% decrease in volumes in Europe and the Americas, with demand lower in all segments, particularly light vehicles. By contrast, the Aluminum business unit posted a 13% year-over-year increase in volumes.

Teksid closed the year with a trading loss of €13 million, compared to break-even for 2012. The decrease was primarily attributable to volume declines.

For 2013 EBIT was a negative €70 million (positive €4 million in 2012), including €60 million in unusual charges, mainly related to impairment of assets in the Cast Iron business unit.

For Q4 2013, Teksid had revenues of €157 million, down 8% over the prior year.

At the trading profit level, there was a loss of €4 million for the quarter, compared with a loss of €7 million for the last quarter of 2012.

EBIT was a negative €63 million (-€6 million for Q4 2012), including the unusual charges referred to above.

Comau

Comau reported revenues of €1,463 million for full-year 2013, substantially in line with the prior year.

Order intake for the Systems activities totaled €1,454 million, representing an 18% increase over 2012. At 31 December 2013, the order backlog totaled €1,022 million, a 17% increase over year-end 2012 attributable primarily to the Body Welding business.

Trading profit for the year totaled €48 million, up €15 million over 2012, with the increase primarily driven by the Body Welding operations.

EBIT was €47 million, compared with €30 million for 2012.

For Q4 2013, Comau reported revenues of €475 million (€402 million for Q4 2012). Order intake for the Systems business totaled €284 million for the quarter, compared with €187 million for the same period in 2012.

Trading profit and EBIT totaled €17 million, compared with €16 million and €14 million, respectively, for Q4 2012.

Significant Events in 2013

Alliances and acquisitions:

- On February 6th, Chrysler Group announced an agreement with Santander Consumer USA Inc. (SCUSA) under which SCUSA, beginning 1 May 2013, would provide a full range of wholesale and retail financing services to Chrysler Group’s US dealers and consumers under the Chrysler Capital brand name.

- On July 30th, Fiat Group Automobiles (“FGA”), Crédit Agricole (“CASA”) and Crédit Agricole Consumer Finance (“CACF”) reached an agreement to extend the 50/50 Joint Venture in FGA Capital (“FGAC”) up to 31 December 2021. The extension of the alliance is intended by the partners to ensure the long-term sustainability of FGAC, a captive finance company that manages FGA’s main activities in retail auto financing, dealership financing, long-term car rental and fleet management in 14 European countries. FGAC will continue to benefit from the financial support of Crédit Agricole Group, while strengthening its own position as an active player in the securitization and debt markets.

- On August 20th, Fiat and Itaú Unibanco renewed the commercial cooperation agreement in place in Brazil since 2003 for a further 10 years. The agreement assures Fiat’s customers and dealer network a strong financial partner that offers a full spectrum of competitive financing solutions. In return, Itaú Unibanco is assured exclusivity for Fiat’s new vehicle financing in promotional campaigns and exclusive use of the Fiat brand in activities related to vehicle financing.

- On July 9th, the CEO of Fiat presented plans for future activities at the plant of Sevel (a 50/50 JV between Fiat Group and PSA Group for the production of Light Commercial Vehicles) located in Atessa, Italy, where the Ducato is currently produced. Approximately €700 million is to be invested in the facility over 5 years.

- On October 28th, Fiat announced that, following receipt of regulatory approvals, Fiat Group Automobiles completed the acquisition of the remaining 50% stake in VM Motori S.p.A. held by General Motors. The purchase consideration was €34.1 million. Fiat acquired an initial 50% stake in VM in 2010 and now has 100% control.

- In connection with its participation in the recapitalization of RCS MediaGroup S.p.A. (RCS), Fiat subscribed 75,791,217 new RCS ordinary shares for a total amount of nearly €94 million (including cost of the rights). Following completion of the RCS capital increase on July 17th, Fiat holds 87,327,360 RCS ordinary shares, representing 20.55% of new ordinary share capital.

Major financing transactions:

- On June 21st, Fiat S.p.A. signed an agreement for a €2 billion 3-year committed revolving credit facility to replace the €1.95 billion 3-year revolving credit facility signed in July 2011. The syndication was successfully completed on July 18 with 19 banks. As a result of the positive response, the facility was increased on that date to €2.1 billion.

- Taking advantage of market conditions and its improved credit profile, on June 21st, Chrysler Group LLC announced that it had reduced the interest rate for its US$3.0 billion Tranche B Term Loan and its undrawn US$1.3 billion revolving credit facility. Certain loan covenants were also amended to be consistent with those in the Company’s bond agreement. Subsequently, on December 23rd, Chrysler Group LLC further reduced the interest rate on the Tranche B Term Loan. The interest rate re-pricing for the two transactions is expected to reduce annual interest costs by approximately US$72 million.

- On November 20th, the European Investment Bank (EIB), SACE and Fiat signed an agreement for €400 million in financing to support R&D programs at five Fiat research centers in Italy for the period 2013 through 2016. The loan from the EIB is 50% guaranteed by SACE.

- Fiat accessed the debt capital market four times during the year:

- an €1.25 billion bond was issued on March 15th (fixed coupon 6.625%, due March 2018).

- an €850 million bond was issued on July 12th (fixed coupon 6.75%, due October 2019). On September 17th, following re-opening of the transaction, a further €400 million of bonds were issued, increasing the total principal amount of the bond to €1.25 billion.

- a CHF 450 million bond was issued on November 22nd (fixed coupon 4.00%, due November 2017).

All of the above bonds were issued by Fiat Finance and Trade Ltd. S.A. and guaranteed by Fiat S.p.A. under the GMTN Program. In all cases the notes were rated ‘B1’ by Moody’s, ‘BB-‘ by Standard & Poor’s and ‘BB-‘ by Fitch.

Rating actions:

- On February 25th, Fitch Ratings lowered its rating on Fiat S.p.A.’s long-term debt from ‘BB’ to ‘BB-‘, while the short-term rating was confirmed at ‘B’, with a negative outlook. Fitch Ratings then confirmed its ratings and outlook on September 18th.

Sustainability:

- In September, as continued recognition of its leadership in sustainability, the Group has been included in the prestigious Dow Jones Sustainability Indices (DJSI) World and Europe for the fifth consecutive year. The company received the maximum score in several key areas of evaluation among economic, environmental and social dimensions. The overall score of 89/100 -compared with an overall average of 61/100 for companies in the Automobiles sector evaluated by RobecoSAM– confirms the Group among the select number of companies judged best-in-class in sustainability.

- On December 3rd, for the second consecutive year, Fiat Group was recognized as the undisputed leader in Italy for its commitment to addressing climate change. On the basis of performance and transparency in disclosure, the Group was named the leader in the CDP[6] Italy 100 Climate Disclosure Leadership Index (CDLI) and Climate Performance Leadership Index (CPLI) for 2013. Fiat received the highest score overall for transparency in disclosure (99/100) and the maximum score (A) for its commitment toward reducing carbon emissions. The Group also participated in other CDP initiatives (CDP Supply Chain, CDP water, CDP Forest) reflecting its commitment to transparent and sustainable management across the supply chain, and to the conservation of natural resources such as water and forests.

Significant Events in 2014

- On January 1st, 2014, Fiat S.p.A. announced an agreement with the VEBA Trust[7], under which its wholly-owned subsidiary, Fiat North America LLC (“FNA”), would acquire all of the VEBA Trust’s equity membership interests in Chrysler Group LLC (“Chrysler Group”), representing 41.4616% of Chrysler Group. The transaction closed on January 21, 2014. In consideration for the sale of its membership interests in Chrysler Group, the VEBA Trust received an aggregate consideration of US$3,650 million consisting of a special distribution paid by Chrysler Group to its members, in an aggregate amount of US$1,900 million (FNA’s portion of the special distribution was paid by FNA to the VEBA Trust as part of the purchase consideration) and a payment from FNA for the remainder of US$1,750 million in cash purchase consideration to the VEBA Trust. Fiat funded the US$1,750 million in cash from available cash on hand and Chrysler Group funded the special distribution from available cash on hand. Contemporaneously, Chrysler Group and the International Union, United Automobile, Aerospace and Agricultural Implement Workers of America (the “UAW”) entered into a memorandum of understanding (“MoU”) to supplement Chrysler Group’s existing collective bargaining agreement. Under the MoU, Chrysler Group will provide additional payments to the VEBA Trust of an aggregate of USD$700 million in four equal annual installments. In consideration for these payments, the UAW has agreed to certain commitments to continue to support the industrial operations at Chrysler and the further implementation of the Fiat-Chrysler alliance, including using best efforts to cooperate in the continued roll-out of Fiat-Chrysler World Class Manufacturing programs.

- On January 7th, 2014 Moody’s Investors Service communicated that it has placed its rating on Fiat S.p.A.’s long term debt (Ba3) and on the notes issued by Fiat Finance and Trade Ltd, S.A. and by Fiat Finance North America, Inc. (B1) under review for possible downgrade.

- On January 10th, 2014, Standard & Poor’s Ratings Services:

- raised its ratings on Chrysler Group LLC, including the corporate credit rating, to ‘BB-‘ from ‘B+’. The outlook is stable.

- confirmed its rating on Fiat S.p.A.’s long-term debt at ‘BB-‘. The short-term rating was confirmed at ‘B’. The outlook remains stable.

[6] CDP is an international not-for-profit organization that provides the only global system for companies and cities to measure, disclose, manage and share essential environmental information relating to impacts measurement and best practices.

[7] The UAW Retiree Medical Benefits Trust, a Voluntary Employees’ Beneficiary Association, is an independently administered trust established to pay health care benefits for retirees from Chrysler.

2014 Outlook

As already announced and now increasingly relevant following the acquisition of the minority stake in Chrysler previously held by the VEBA Trust, the Group will be presenting an updated business plan in early May 2014 that will give increased visibility of the Group’s strategic direction and execution priorities. Notwithstanding that process the Group indicates the following guidance for 2014:

- Revenues:~€93 billion

- Trading Profit: ~€3.6 to €4.0 billion

- Net Income: ~€0.6 to €0.8 billion, with EPS to improve from ~€0.10 (ex-unusuals) to ~€0.44-€0.60. Includes increased deferred tax charge of ~€0.5 billion due to the recognition of net deferred tax assets at year-end 2013 related to Chrysler.

- Net Industrial Debt: €9.8 billion to €10.3 billion. Includes cash outflows for the January 21st, 2014 closing of the purchase of the remaining 41.5% minority stake in Chrysler Group LLC from the VEBA Trust (€2.7 billion), in addition to the impact of the adoption of IFRS 11, effective January 1st, 2014 (~€0.3 billion).

|

John Elkann Chairman |

Sergio Marchionne Chief Executive Officer |

*********

The manager responsible for preparing the Company’s financial reports, Richard Palmer, declares, pursuant to Article 154-bis (2) of Legislative Decree 58/98, that the accounting information contained in this press release corresponds to the results documented in the books, accounting and other records of the Company.

*********

This press release, and in particular the section entitled “2014 Outlook”, contains forward-looking statements. These statements are based on the Group’s current expectations and projections about future events and, by their nature, are subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them. Actual results may differ materially from those expressed in such statements as a result of a variety of factors, including: volatility and deterioration of capital and financial markets, including further worsening of the Eurozone sovereign debt crisis, changes in commodity prices, changes in general economic conditions, economic growth and other changes in business conditions, weather, floods, earthquakes or other natural disasters, changes in government regulation (in each case, in Italy or abroad), production difficulties, including capacity and supply constraints and many other risks and uncertainties, most of which are outside of the Group’s control.

The terms “Fiat”, “Fiat Group” or simply “Group” are used to identify Fiat S.p.A. together with its direct and indirect subsidiaries which include, beginning 1 June 2011, Chrysler Group LLC and its direct and indirect subsidiaries following the acquisition of control. Fiat and Chrysler will continue to manage financial matters, including funding and cash management, separately. Additionally, Fiat has not provided guarantees or security or undertaken any other similar commitment in relation to any financial obligation of Chrysler, nor does it have any commitment to provide funding to Chrysler in the future.

Turin, 29 January 2014

The Board of Directors met today at the headquarters of Fiat S.p.A. in Turin, Italy.

On January 29th, at 3 p.m. CET (2 p.m. GMT, 9 a.m. EST) management will hold a combined conference call to present the Fiat S.p.A. and Chrysler Group LLC’s 2013 full year and fourth quarter financial results to financial analysts and institutional investors. The call can be followed live and a recording will be available later on the Group websites: www.fiatspa.com and www.chryslergroupllc.com. The supporting document will be made available on the Fiat and Chrysler websites prior to the call.