- Analysis of 52 markets found that 84.24 million units were sold in 2016, which was driven by increased demand in China, India and Europe

- China saw double-digit growth in sales, while demand in the US remained stable

- Global demand for SUVs continued, with significant sales increases in the segment across South East Asia, Europe and China

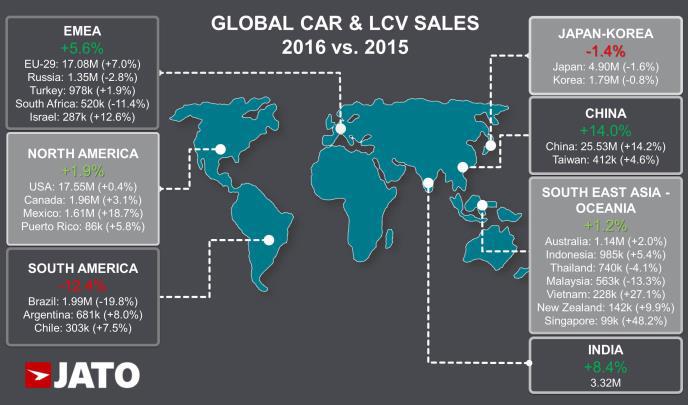

The global automotive industry showed its resilience in 2016 with 84.24 million units (LCVs and passenger cars) sold according to data released today by JATO Dynamics. This is a 5.6% increase on 2015 and shows the sector’s strength amidst the uncertainty of 2016. “Despite the hurdles faced by the automotive industry last year, an increase in registrations of 5.6% shows the sector’s resilience. The growth shows that the declines in Japan, Russia and Brazil were offset by strong results in China and Europe,” commented Felipe Munoz, JATO’s Global Analyst.

The expansion of the car purchase restrictions policy in China caused a slowdown in the market at the beginning of the year. However, demand recovered during H2, with consistent monthly double-digit growth. 2016 was a mixed year for the US, with a decline in registrations in five of the twelve months. This resulted in the overall volume of registrations in 2016 increasing by just 0.4% compared to 2015.

Japanese car sales decreased by 1.6% compared to 2015, signalling a slowdown in the retraction of the industry when compared to the sharp fall of 9.5% seen in 2015. Tax increases on Kei-cars continued to impact the Japanese market in 2016, with city-cars posting a decline of 4.2%. The decline in registrations in Brazil was particularly dramatic, with 500,000 less units registered compared to the previous year. 2016’s total was a significant 45% lower than the record 3.63 million units posted in 2012.

The declines in these markets were offset by double-digit growth in China and Europe’s slow, consistent recovery. European car and LCV registrations totalled 17.1 million units, which is a significant increase of 7% on 2015. Click here to see full European car registrations details.

In the emerging markets, India showed its strength with more than 3.3 million units sold as a result of growing prosperity and the greater availability of consumer credit. India’s growth offset losses in other emerging markets, and established India as a solid source of revenue for car manufacturers.

Toyota maintained its leading position as the world’s most popular car brand, despite losing ground in the US and China. Overall it increased sales during 2016 thanks to strong results in emerging markets such as Indonesia and Mexico.

Despite the emissions issue, the Volkswagen brand increased its sales by 2.8% during 2016. Its Chinese operations remained largely unaffected by the scandal, with its sales continuing to grow. This allowed the brand to offset significant declines in Brazil, the US and Russia. In contrast, in Europe, Volkswagen posted the highest market share drop of any brand as a result of the issue.

Honda, Kia and Mercedes were the best performers in the top 10, as a result of their latest launches capitalising on the SUV boom.

Other brands which experienced notable growth in 2016 include:

- Renault’s performance was boosted by a 28.1% increase on its SUV sales, and its dramatic improvement in India where it experiened a 146% increase in registrations due to the popularity of the Kwid.

- Buick’s Chinese sales accounted for 82% of its global results and its Excelle compact sedan was the country’s third best-selling car.

- Jeep’s performance was boosted by the popularity of the Renegade B-SUV and as a result the brand increased its sales in the US, became a market leader in Brazil, and sold more than 100k units in Europe.

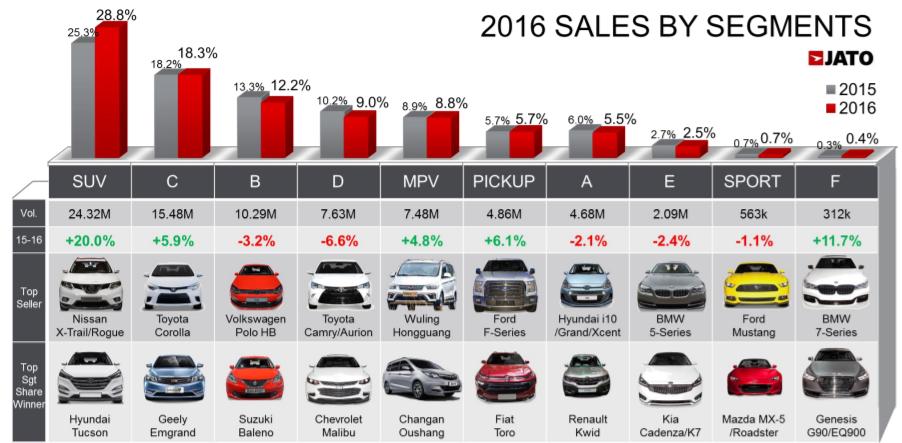

Demand in the US for large pickups continued to fuel the success of the Ford F-Series and as a result it became the world’s best-selling car.

Meanwhile, the Volkswagen Golf suffered a dip in demand in its largest market, Europe, as a consequence of stronger competition and the impact of the emissions issue.

2016’s best-selling SUV was the Nissan X-Trail/Rogue, which overtook the Honda CR-V – which had occupied the lead position for some years as a result of strong growth in the US, China and Europe. Other big increases include the Honda HR-V (aka XR-V or Vezel), the Great Wall Hover midsize SUV and the twins Hyundai Tucson – Kia Sportage.

The segment ranking indicates that SUVs were the largest drivers of growth, with its volume accounting for almost 29% of all cars, pickups and LCVs sold last year. The majority of these registrations were in the C-SUV subsegment, but the smallest subsegment (B-SUV) posted the highest growth of 28.0%.

“SUVs have continued to take market share away from traditional segments, and this trend isn’t restricted to particular markets – it’s a trend that we’ve seen on a global scale and expect to continue in 2017,” concluded Munoz.

GLOBAL CAR SALES 2016 (FULL LIST)

About JATO

JATO was founded in 1984 and provides the world’s most timely, accurate and up-to-date information on vehicle specifications and pricing, sales and registrations, news and incentives.

The company has representation in over 40 countries, providing unique local market expertise. The JATO client base includes all of the world’s volume vehicle manufacturers; giving them the ability to react to short-term market movements, plan for long-term developments and ultimately to meet consumers’ needs.

JATO’s intelligence has also been adapted for consumer use in motoring web portals where customers can see the advantages and disadvantages of a specified model against any other.

Major leasing companies use JATO’s intelligence to drive the vehicle quotation process. Visit JATO at www.jato.com for more information.

For media use only. Advertising and/or any other promotional use of the information contained within this release must be pre-agreed with JATO Dynamics Ltd.