RECORD SALES FOR GROUPE RENAULT, UP 13.3% TO 3.18 MILLION VEHICLES IN 2016 FOR THE LAST YEAR OF THE RENAULT DRIVE THE CHANGE

- Record year-on-year increase of 374,000 units (13.3%), up to 3.18 million vehicles sold in 2016.

- Record year for Renault, top French brand worldwide, and Dacia, and Renault Samsung Motors volumes up by 38.8%.

- Market share up in all regions: Renault brand number-two in Europe, while the Alliance is the number-two automotive group.

- Sustained growth ambitions for Renault in 2017, with young product range, new releases, and international development.

WORLD SALES RECORD

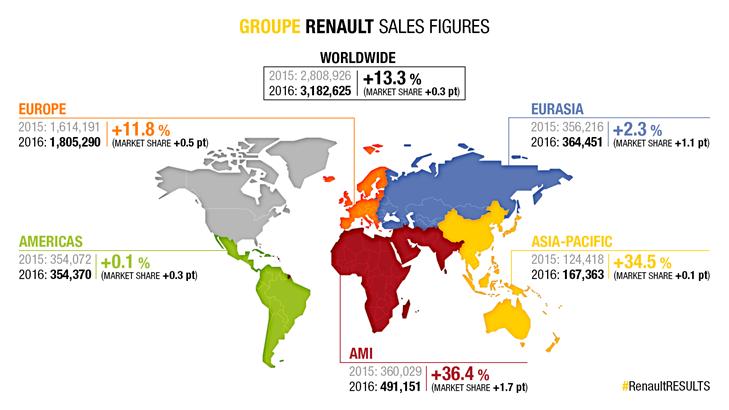

Under the impetus of the Drive the Change plan, sales are on the rise for the fourth year running, making Groupe Renault the number-one French automotive group worldwide, with 3,182,625 vehicles registered in 2016.

Groupe Renault worldwide passenger car and light commercial vehicle sales rose by 13.3% in 2016, against 4.6% for the market as a whole. The group’s share of the world automotive market stands at 3.5% (up 0.3 points vs 2015). Both Renault and Dacia brands have registered record sales. Renault keeps its position as the world’s leading French brand. Renault Samsung Motors sales rose by 38.8%.

The group continued to benefit from buoyant conditions on the European automotive market (up 7% on 2015), with registrations up 11.8% to 1,805,290, for a market share of 10.6%.

Outside Europe, Groupe Renault achieved record sales in 2016, up 15.3% on 2015 against growth of 5.2% on the market as a whole. Volumes and market shares were up in all regions.

“In 2016 we sold 3.18 million vehicles worldwide, setting a new sales record. Our strategy of product range renewal and geographic expansion, under way for several years now, has proven to be successful. It enables the Groupe Renault to progress significantly in terms of volume and market share in each region.” notes Thierry Koskas, member of the Executive Committee and Group Executive VP for sales & marketing.

RENAULT SECOND BRAND IN EUROPE

In Europe, Groupe Renault’s market share (passenger cars and light commercial vehicles) rose by 0.5 points to 10.6%. Registrations rose by 11.8% to 1,805,290. Sales were up in all the countries in the region.

Sales were up again for the Renault brand, which becomes Europe’s second biggest automotive brand. With 1,390,280 vehicle registrations (up 12.1% on 2015), Renault’s market share rose 0.4 points on 2015 to reach 8.1%.

On the passenger car market, Renault’s market share rose more than any other brand in Europe, by 0.4 points. It is mainly due to the successful product range renewal programme including Espace, Talisman and the Mégane family. New Scénic got off to a good start, with more than 19,000 orders in its first quarter on the market.

Renault kept its leadership in B-segment city cars, owing to successful showings from Clio and Captur, which heads its segment at 215,670 units.

On the European light commercial vehicle market, Renault brand sales rose 9.9% to reach 296,187 vehicles, for a market share of 14.8%.

After eleven years on the European market, Dacia brand sales were again up in 2016 (by 10.8%), at a record 415,010 registrations.

The Renault brand stays at the top of the European electric vehicles market, with sales up by 11 % at 25,648 units (excluding Twizy). ZOE heads the electric passenger car ranking with 21,735 registrations (up 16%) and Kangoo Z.E. the electric light commercial vehicle market with 3,901 vehicles sold.

In France, Groupe Renault achieved its best sales performance in five years. Renault widened its lead as France’s leading automotive brand, with a 22.3% of the passenger car and light commercial vehicle market, while Dacia sales hit a record high of 112,000 units, ranking fourth for sales to private motorists.

INTERNATIONAL GROWTH

Despite uneven economic situations across the globe, Groupe Renault strengthened its positions to increase its market share in all regions. Again, its product range renewal programme bore fruit, with Kwid in India, QM6 and SM6 in Korea, Kaptur in Russia, Koleos in China, Megane Sedan in Turkey and Oroch in Latin America.

In the Africa / Middle East / India region, Groupe Renault registrations rose by 36.4%, giving a market share of 6.2% (up 1.7 points).

In India, Renault kept its position as best-selling European automotive brand, with sales up by 145.6%. Kwid registrations totalled 105,745. India rose five places to become the group’s eighth biggest market worldwide.

In Iran, sales boomed by 110.7% to give Groupe Renault an 8.4% market share, up 3.7 points on 2015. The group has reclaimed its position as a major player on the Iranian market, doubling its market share in a single year thanks to successful performance from Tondar and Sandero.

In North Africa, Groupe Renault holds a 38.5% market share, up by 4.9 points. In Algeria, its market share reached a record 51.3% in 2016, up by 15.7 points, benefiting from local production of Symbol.

In Morocco, where Dacia and Renault hold first and second places respectively, Groupe Renault registrations rose by 22.5%, with record sales yielding a market share of 37.8%.

In the Eurasia region, registrations rose by 2.3% despite market shrinkage of 6.3%. Market share rose accordingly, by 1.1 points to 13.0%, largely driven by strong performance with record sales in Turkey (up 4.4%). New Mégane Sedan got off to a good start, with orders topping 13,200 in the first two months.

Sales growth in most of the countries in the region offset the impact of the economic crisis in Russia, where the market collapsed by 10.8%. Renault was able to contain the decline in its sales here at 2.6%, to achieve a record market share of 8.2%, up by 0.7%, chiefly owing to successful performance from Kaptur, which sold more than 14,600 units since it was launched in June.

In the Americas region, Groupe Renault sales rose by 0.1% despite market shrinkage of 4.1%, holding up well to the economic difficulties with a market share of 6.5%, up by 0.3 points.

In Brazil, market share rose by 0.2 points to a record 7.5%, on a market that slipped back 19.8% thanks to the successful performance of Duster Oroch. In 2017, the group will benefit of its brand new SUV range with Captur, Kwid and New Koleos as well as the arrival of Alaskan. The Renault brand continues to reap the benefits of pickup on the Argentinian market, with registrations up by 24.8% against growth of 9.1% in the market as a whole. In Colombia, sales volume and market share hit records (21.3%).

In the Asia Pacific region, Renault Samsung Motors sales rose 38.8% in South Korea despite the 0.3% shrinkage of the market: the market share was up 1.7 points at 6.2% thanks to the successful launches of SM6 and QM6 in 2016. QM6 orders reached 21,000 in just four months.

In China, following release of Kadjar, the first vehicle made locally by the Dongfeng Renault joint venture, Renault sales rose by 50.8% against market growth of 14.0%. New Koleos orders approached 10,000 in just two months.

GROUPE RENAULT SALES OUTLOOK FOR 2017

In 2017, the global market is expected to grow by 1.5% to 2% compared with 2016. The European market is also expected to increase by 2%, with a 2% increase also for France.

At the International level, the Brazilian and Russian markets are expected to become stable. China shall grow by 5% and India by 8%.

Groupe Renault should continue to reap the benefit of product range renewal in Europe, and of the strong dynamic on international markets, with Kwid in India, Koleos and Kadjar in China, Kaptur in Russia, QM6 and SM6 in South Korea, and Alaskan plus the SUV range in Latin America.

Groupe Renault therefore expects a sustained growth in sales volumes and market shares in Europe and in the international markets.

| Group sales by region PC+LCV | ||||

| December YTD* | ||||

| 2016 | 2015 | % var. | ||

| France | 651 778 | 607 173 | 7,3% | |

| Europe** (Excl France) | 1 153 512 | 1 007 018 | 14,5% | |

| France + Europe Total | 1 805 290 | 1 614 191 | 11,8% | |

| Africa Middle East India | 491 151 | 360 029 | 36,4% | |

| Eurasia | 364 451 | 356 216 | 2,3% | |

| Americas | 354 370 | 354 072 | 0,1% | |

| Asia Pacific | 167 363 | 124 418 | 34,5% | |

| Total Excl France + Europe | 1 377 335 | 1 194 735 | 15,3% | |

| World | 3 182 625 | 2 808 926 | 13,3% | |

| * Sales | ||||

| ** Europe = European Union, except Romania, Bulgaria & Island, | ||||

| Norvway & Switzerland, Albania, Bosnia, Macedonia, Malta, Montenegro, Serbia | ||||

| Sales by brand | |||

| December Ytd* | |||

| 2016 | 2015 | % var | |

| RENAULT | |||

| VP | 2 094 542 | 1 829 832 | 14,5% |

| VU | 392 767 | 348 127 | 12,8% |

| VP+VU | 2 487 309 | 2 177 959 | 14,2% |

| RENAULT SAMSUNG MOTORS | |||

| VP | 111 097 | 80 028 | 38,8% |

| DACIA | |||

| VP | 542 542 | 511 501 | 6,1% |

| VU | 41 677 | 39 438 | 5,7% |

| VP+VU | 584 219 | 550 939 | 6,0% |

| GROUPE RENAULT | |||

| VP | 2 748 181 | 2 421 361 | 13,5% |

| VU | 434 444 | 387 565 | 12,1% |

| VP+VU | 3 182 625 | 2 808 926 | 13,3% |

| Groupe Renault : 15 markets – December Ytd | |||

| Volumes 2016* | MS VP+VU 2016 | ||

| (units) | (% ) | ||

| 1 | FRANCE | 651 778 | 26.87 |

| 2 | GERMANY | 198 609 | 5.49 |

| 3 | ITALY | 190 610 | 9.37 |

| 4 | SPAIN | 170 272 | 12.90 |

| 5 | TURKEY | 169 236 | 17.20 |

| 6 | BRAZIL | 149 977 | 7.55 |

| 7 | UNITED KINGDOM | 138 642 | 4.51 |

| 8 | INDIA | 132 235 | 3.95 |

| 9 | RUSSIA | 117 227 | 8.21 |

| 10 | SOUTH KOREA | 111 087 | 6.19 |

| 11 | IRAN | 108 536 | 8.44 |

| 12 | ARGENTINA | 99 097 | 14.50 |

| 13 | BELGIUM+LUXEMBOURG | 92 247 | 13.82 |

| 14 | MOROCCO | 61 726 | 37.84 |

| 15 | ALGERIA | 61 249 | 51.32 |

| *2016 full year (sales), excl Twizy | |||