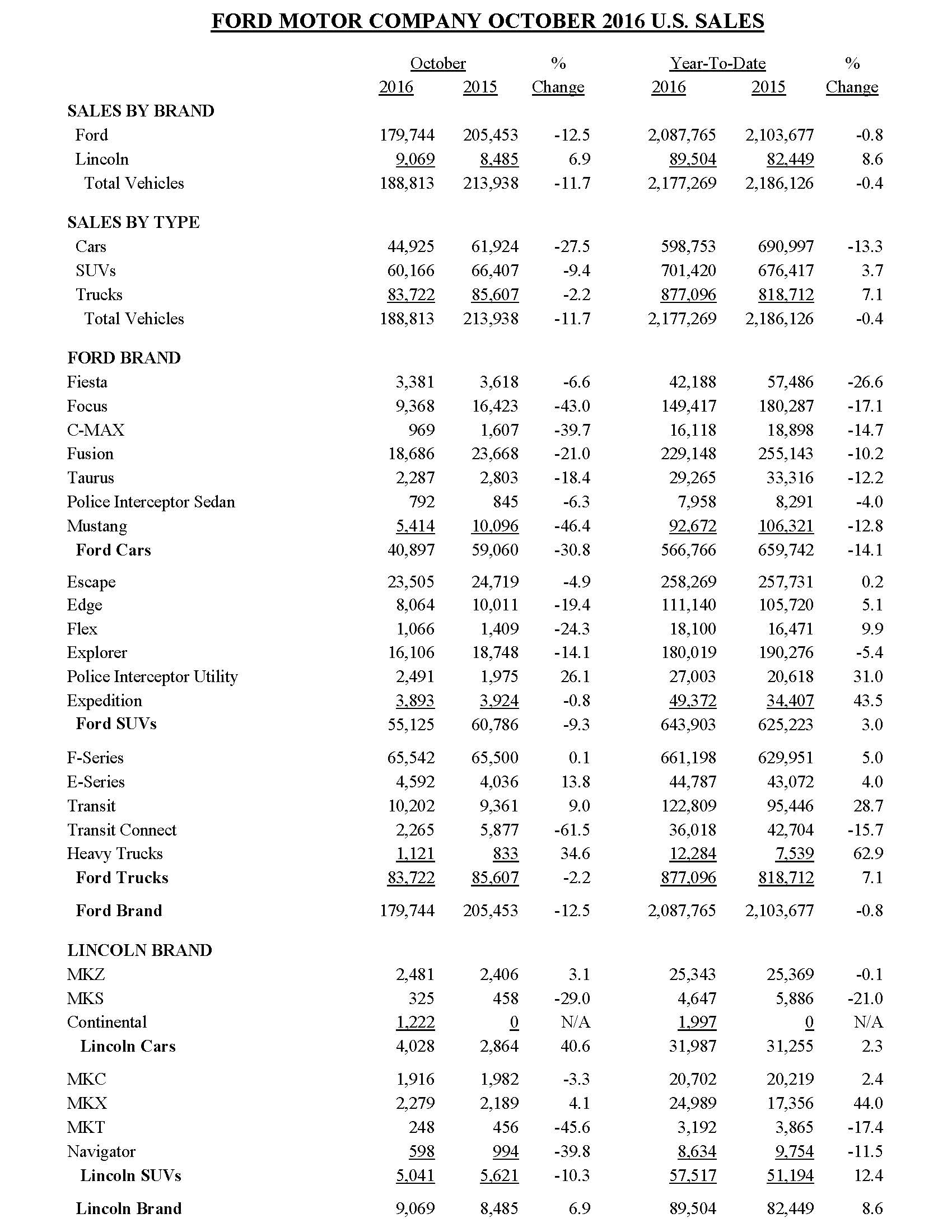

- Total Ford Motor Company U.S. October sales of 188,813 vehicles down 12 percent from a year ago; retail sales decline 7 percent, fleet sales down 24 percent

- Ford Transit sales totaled 10,202 vehicles, up 9 percent

- Ford F-Series retail sales up 2 percent, driven by strong Super Duty demand; overall F-Series sales increase 0.1 percent, with 65,542 trucks sold

- Lincoln sales increase 7 percent – with gains coming from MKX, MKZ and the all-new Continental; retail sales up 10 percent

DEARBORN, Mich., Nov. 2, 2016 – Overall U.S. sales for Ford were down 12 percent in October versus a year ago, with 188,813 vehicles sold.

U.S. sales of Ford Transit were up 9 percent, with 10,202 vans sold. F-Series pickup sales increased 0.1 percent, with 65,542 trucks sold – the best October since 2004.

Ford is reporting sales today due to a fire Monday at its World Headquarters, which interrupted power to one of the company’s main data centers that the company and its dealers use to report and track sales. October reporting was extended to 8 p.m. EDT Tuesday, giving U.S. dealers an opportunity to report month-end sales.

October retail sales totaled 143,145 vehicles, down 7 percent. Fleet sales of 45,668 vehicles, including daily rental, commercial and government segments, were down 24 percent, driven primarily by front-loading daily rental deliveries this year, prioritizing Super Duty retail customers and pausing Transit Connect sales to address the previously announced door latch recall.

Lincoln sales totaled 9,069, a 7 percent increase. Retail sales were up 10 percent. Growth came from Lincoln’s new products, with total MKX up 4 percent, MKZ up 3 percent and all-new Continental sales of 1,222 vehicles.

Truck sales remained positive for Ford, with F-Series retail sales up 2 percent on strong Super Duty demand. High-end series Lariat, King Ranch and Platinum pickups represented 75 percent of retail sales. 2017 Super Duty was 36 percent of overall Super Duty retail sales in October.

“High customer demand for our new Super Duty, including top-trim-level pickups, continues to boost transaction prices,” said Mark LaNeve, vice president for U.S. Marketing, Sales and Service. “New Super Duty is turning on dealer lots in just 18 days, and Ford’s average transaction prices are up $1,600 versus a year ago – far outpacing the industry average of $600.”

Ford’s overall average transaction prices were up $800 versus September, while industry transaction prices were up $460 compared to September.

Overall incentive spending at Ford was up approximately $180 compared to year ago, versus an industry increase of $390. Compared to September, Ford’s overall incentive spend was down $570.

The company’s days’ supply for October was 90 days. Ford has been taking actions to match production with demand, as outlined during the company’s third quarter financial results and is well positioned for Black Friday and year-end sales events. The company’s fourth-quarter North American production guidance of 700,000 vehicles remains unchanged.

| Gross Stock | 2016 | 2016 | 2015 |

| October | September | October | |

| Passenger Car | |||

| Unit Volume | 145,000 | 153,000 | 168,000 |

| SUV | |||

| Unit Volume | 190,000 | 184,000 | 152,000 |

| Trucks | |||

| Unit Volume | 315,000 | 314,000 | 302,000 |

| Total | |||

| Unit Volume | 650,000 | 651,000 | 622,000 |

| Days’ Supply | 90 | 80 | 79 |

| Fleet % of Total Sales | 2016 | 2015 | |

| October | October | ||

| Daily Rental | 7% | 10% | |

| Commercial | 11% | 12% | |

| Government | 6% | 6% | |

| Total | 24% | 28% |