- European new car sales grew 6.4% in April, 8.5% year-to-date

- All Big 5 EU markets recorded increased registrations in April

- Volkswagen Golf, Renault Clio and Ford Fiesta were the best-selling cars for the month

New car sales in Europe were 6.4% higher in April 2015 than in the same month of 2014, according to the latest new car sales analysis from JATO Dynamics, the world’s leading provider of automotive intelligence. Year-to-date sales were 8.5% higher than a year earlier.

JATO’s headline market analysis:

- Volkswagen’s Golf maintained its lead, with sales up 4.2% year-to-date, ahead of Renault Clio and Ford Fiesta

- Spain recorded a 3.9% increase over an already strong April last year

- All of the top ten brands increased their sales for April and the year-to-date over 2014

Continuing the trend of recent months, all of the Big five markets (France, Germany, Great Britain, Italy and Spain) recorded greater registration volumes than a year ago. After an increase of over 40% in March, Spain recorded only a 3.9% increase in April, but sales in April 2014 were unseasonably high, and the country joins the Czech Republic, Ireland and Portugal in achieving year-to-date growth above 20%.

Brian Walters, Vice President of Data at JATO Dynamics, commented, “Consumer confidence remains high in many European markets, leading to improved sales for the car industry across the continent. While some may view the lower growth in Spain this month as a sign of a softening market, taken in context with the monthly figures from previous years it is a return of the normal seasonality, but at a much higher level than before.”

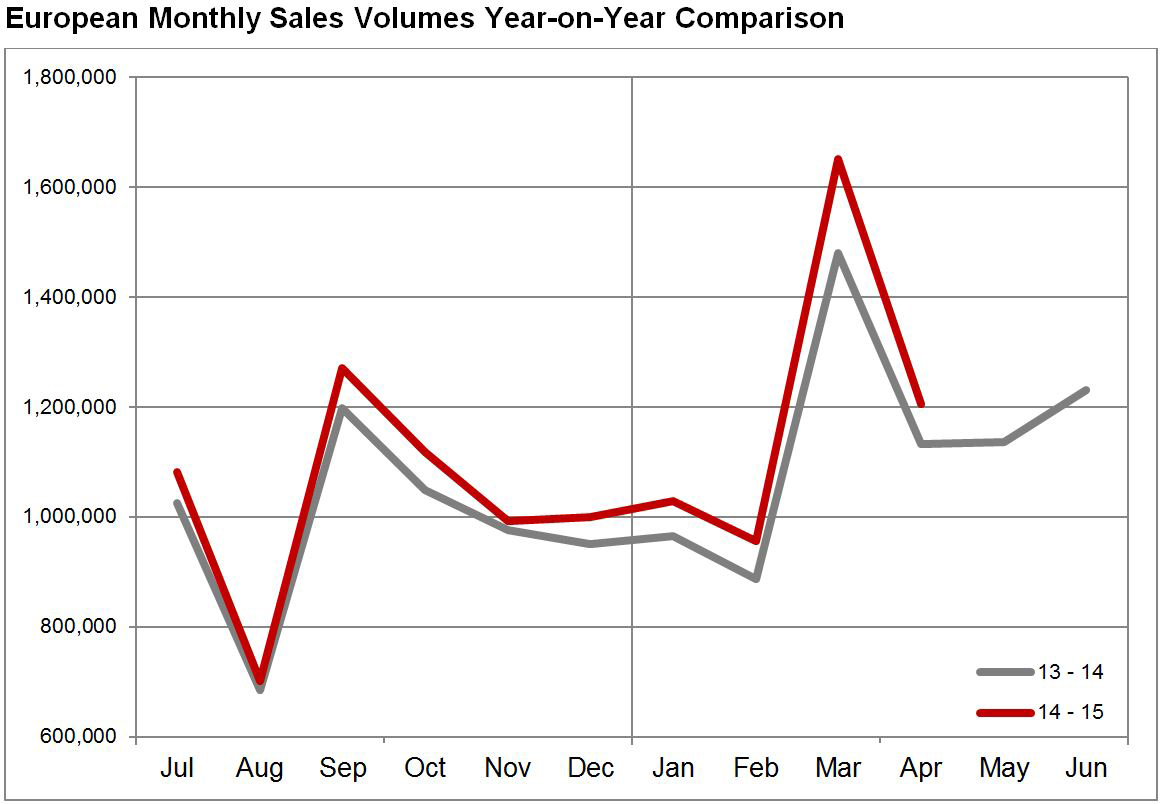

European Monthly Sales Volumes Year-on-Year Comparison

Volkswagen maintained its dominant position at the top of the sales table, increasing sales by 5.5% in April and 9.4% year-to-date. Ford, Renault, Opel/Vauxhall and Peugeot complete the top five for the month, while Ford is ahead of Renault in 2nd place for the year-to-date.

All of the top ten brands recorded increased volumes compared to April 2014. Renault achieved the strongest growth, up 15.2% in April and 13.4% year-to-date, thanks to continued strong sales of the Clio and Captur, and impressive sales of the new Twingo city car.

Top Ten Brands

| Make | Apr_15 | Apr_14 | % change Apr | Apr Ytd_15 | Apr Ytd_14 | % change Ytd |

| VOLKSWAGEN | 154,058 | 146,026 | +5.5% | 589,352 | 538,720 | +9.4% |

| FORD | 87,839 | 86,077 | +2.0% | 359,708 | 339,234 | +6.0% |

| RENAULT | 86,963 | 75,478 | +15.2% | 329,963 | 291,068 | +13.4% |

| OPEL/VAUXHALL | 76,670 | 73,202 | +4.7% | 318,071 | 299,318 | +6.3% |

| PEUGEOT | 73,522 | 69,862 | +5.2% | 295,962 | 277,477 | +6.7% |

| AUDI | 70,031 | 67,584 | +3.6% | 261,991 | 252,169 | +3.9% |

| BMW | 60,586 | 56,275 | +7.7% | 242,714 | 225,166 | +7.8% |

| FIAT | 58,949 | 54,370 | +8.4% | 229,276 | 211,957 | +8.2% |

| MERCEDES | 58,711 | 57,617 | +1.9% | 239,503 | 215,421 | +11.2% |

| SKODA | 55,536 | 51,150 | +8.6% | 206,604 | 194,378 | +6.3% |

Outside the top ten brands Jeep’s new Renegade and Cherokee models continue to sell well contributing to a 170% increase in the brand’s April sales. Infiniti saw sales increase across the brand by 105% as more British customers bought their cars, and Tesla recorded an 87.2% increase as its Model S electric executive car continues to win customers in many markets.

The Volkswagen Golf retained its lead of the market but saw total sales for the month decline by 0.7%, losing market share in Germany, Spain and France. In contrast, its sibling, the new generation Passat achieved a 46.5% increase, the greatest growth in the top ten.

Renault’s Clio claimed 2nd place for the month, and posted a 14.2% increase in sales over April 2014 due to strong performances in Italy and Spain.

Outside the top ten, Peugeot’s new 308 continues to sell over 40% ahead of its predecessor’s performance last year, and the addition of 5-door versions to the latest generation of the MINI hatchback has driven a 92.2% increase in the model’s volumes in April, and a doubling year-to-date sales.

Top Ten Models

| Make & Model | Apr_15 | Apr_14 | % change Apr | Apr Ytd_15 | Apr Ytd_14 | % change Ytd |

| VOLKSWAGEN GOLF | 49,330 | 49,663 | -0.7% | 186,758 | 179,256 | +4.2% |

| RENAULT CLIO | 29,973 | 26,244 | +14.2% | 110,144 | 100,679 | +9.4% |

| FORD FIESTA | 26,717 | 28,428 | -6.0% | 114,665 | 114,018 | +0.6% |

| VOLKSWAGEN POLO | 25,180 | 23,383 | +7.7% | 103,887 | 96,757 | +7.4% |

| OPEL/VAUXHALL CORSA | 22,893 | 20,402 | +12.2% | 101,715 | 85,289 | +19.3% |

| FORD FOCUS | 21,057 | 20,158 | +4.5% | 82,038 | 81,274 | +0.9% |

| VOLKSWAGEN PASSAT | 20,188 | 13,777 | +46.5% | 71,906 | 50,490 | +42.4% |

| AUDI A3/S3/RS3 | 19,861 | 18,884 | +5.2% | 74,259 | 68,848 | +7.9% |

| PEUGEOT 208 | 19,404 | 19,464 | -0.3% | 80,252 | 81,882 | -2.0% |

| NISSAN QASHQAI | 18,728 | 19,526 | -4.1% | 84,070 | 73,317 | +14.7% |

“Although total sales volumes of some popular models slipped in April, the market remains buoyant overall, as demonstrated by the results of the ten biggest-selling brands,” concluded Brian Walters.

About JATO

JATO was founded in 1984 and provides the world’s most timely, accurate and up-to-date information on vehicle specifications and pricing, sales and registrations, news and incentives.

The company has representation in over 50 countries, providing unique local market expertise. The JATO client base includes all of the world’s volume vehicle manufacturers; giving them the ability to react to short-term market movements, plan for long-term developments and ultimately to meet consumers’ needs.

JATO’s intelligence has also been adapted for consumer use in motoring web portals where customers can see the advantages and disadvantages of a specified model against any other.

Major leasing companies use JATO’s intelligence to drive the vehicle quotation process.

Visit JATO at www.jato.com for more information.

Notes to editors

Sales by Market

| Country | Apr_15 | Apr_14 | % change Apr | Apr Ytd_15 | Apr Ytd_14 | % change Ytd |

| Austria | 29,500 | 29,240 | +0.9% | 104,654 | 110,521 | -5.3% |

| Belgium | 51,423 | 53,319 | -3.6% | 198,496 | 201,851 | -1.7% |

| Croatia | 3,694 | 4,576 | -19.3% | 11,655 | 11,851 | -1.7% |

| Cyprus* | 646 | 601 | +7.5% | 2,729 | 2,606 | +4.7% |

| Czech Republic | 20,568 | 17,498 | +17.5% | 73,833 | 60,491 | +22.1% |

| Denmark | 16,951 | 16,497 | +2.8% | 66,208 | 64,323 | +2.9% |

| Estonia | 2,025 | 2,043 | -0.9% | 6,949 | 6,788 | +2.4% |

| Finland | 9,632 | 9,311 | +3.4% | 38,970 | 39,782 | -2.0% |

| France | 170,714 | 166,864 | +2.3% | 647,948 | 612,609 | +5.8% |

| Germany | 291,341 | 274,097 | +6.3% | 1,049,025 | 985,850 | +6.4% |

| Great Britain | 185,778 | 176,820 | +5.1% | 920,366 | 864,942 | +6.4% |

| Greece* | 6,256 | 5,649 | +10.7% | 21,945 | 20,500 | +7.0% |

| Hungary | 6,752 | 5,601 | +20.5% | 23,869 | 21,225 | +12.5% |

| Ireland | 9,471 | 7,823 | +21.1% | 74,187 | 57,724 | +28.5% |

| Italy | 149,058 | 120,508 | +23.7% | 580,777 | 500,695 | +16.0% |

| Latvia | 1,238 | 1,067 | +16.0% | 4,448 | 3,917 | +13.6% |

| Lithuania | 1,746 | 1,417 | +23.2% | 5,507 | 4,773 | +15.4% |

| Luxembourg | 5,046 | 5,220 | -3.3% | 16,902 | 17,531 | -3.6% |

| Norway | 13,039 | 12,401 | +5.1% | 48,692 | 49,153 | -0.9% |

| Poland | 28,526 | 27,731 | +2.9% | 120,191 | 103,260 | +16.4% |

| Portugal* | 13,237 | 12,318 | +7.5% | 59,475 | 46,291 | +28.5% |

| Romania | 5,482 | 4,932 | +11.2% | 19,915 | 18,277 | +9.0% |

| Serbia* | 1,905 | 1,931 | -1.3% | 5,782 | 5,913 | -2.2% |

| Slovakia | 6,462 | 5,889 | +9.7% | 22,802 | 21,680 | +5.2% |

| Slovenia | 5,348 | 4,876 | +9.7% | 20,995 | 18,675 | +12.4% |

| Spain | 84,024 | 80,882 | +3.9% | 351,872 | 284,997 | +23.5% |

| Sweden | 30,536 | 27,543 | +10.9% | 106,269 | 95,346 | +11.5% |

| Switzerland | 28,265 | 27,537 | +2.6% | 100,050 | 96,067 | +4.1% |

| The Netherlands | 27,222 | 28,635 | -4.9% | 137,653 | 136,974 | +0.5% |

| Grand Total | 1,205,885 | 1,132,826 | +6.4% | 4,842,164 | 4,464,612 | +8.5% |

NOTE: * denotes estimated data included for Apr_15