- Vehicle stock in China expected to increase by almost 50%

- In 2030, more than one in three kilometres driven will be ‘shared’

- 40% of the mileage driven could be done in autonomous vehicles in 2030

- Personal mileage could rise by 23% in Europe, 24% in the US and 183% in China

- 55% of cars set to be electric in 2030

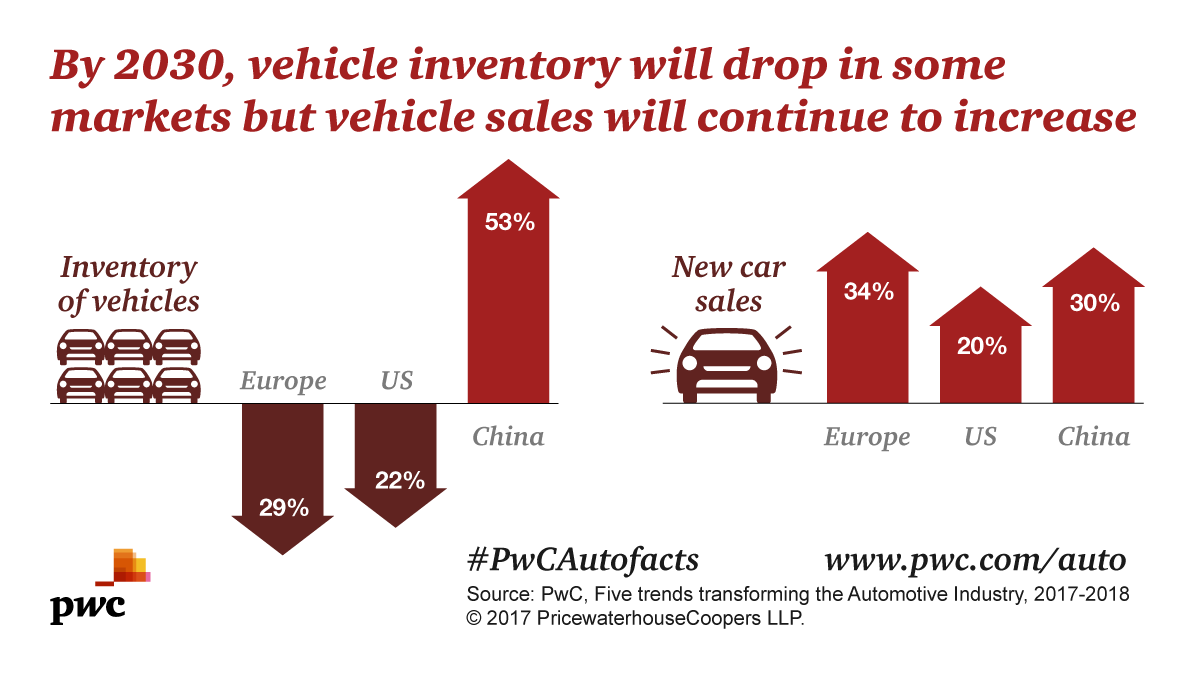

The automotive market will face radical change in 2030, according to research by PwC. As a result of novel sharing concepts, the stock of cars could fall from 280 to 200 million in Europe and 270 to 212 million in the United States. China, in contrast, is expected to see its vehicle inventory rise to 280 million vehicles in 2030, up from 180 million today.

The PwC report – “Five trends transforming the Automotive Industry” – outlines a series of seemingly contradictory findings. For example, while vehicle stock could fall dramatically in Europe and the US in 2030, traffic on the roads will become even heavier. And although the number of new registrations will rise considerably, many conventional manufacturers and suppliers will come under pressure.

By 2030, one in three kilometres driven will be ‘shared’

“This picture only appears to be contradictory. This automotive revolution will see many rules that the industry has become accustomed to over many decades being turned on their head,” says Felix Kuhnert, PwC’s Global Automotive Leader.

Of particular importance here is the growth of low-cost sharing concepts predicted by PwC. As a result of this development: “In only a few years’ time, today’s norm where most people drive themselves in their own vehicle will only be one mobility concept among many,” says Christoph Stürmer, Global Lead Analyst at PwC Autofacts. The PwC study anticipates that as early as 2030, more than one in three kilometres driven will be under one of the many forms of ‘sharing’.

Electric and self-driving cars will accelerate the change

This trend towards ‘sharing’ will be coupled with two megatrends in automotive technology – the electrification of drive systems and huge advances in the development of self-driving cars. Under PwC’s scenario, by 2030, 55% of all new vehicles may be electric cars, while the conventional combustion engine will slowly die out.

Developments in Europe and the US are expected to happen at a roughly parallel pace. In China, by contrast, the penetration of shared and autonomous mobility will happen faster than in the Western world. This could make China the leading market for the transformation of the automotive industry.

“The various different trends will reinforce each other”, says Christoph Stürmer. “For instance, electric vehicles are less susceptible to failure thanks to their simpler power train – which is a significant advantage where vehicles are being shared and used more intensively. Self-driving cars, in turn, could effectively become ‘robotaxis’ if they are combined with sharing concepts.”

Road traffic set to change radically

Taken in combination, the various megatrends will mean that road traffic as a whole will change radically. With more and more people turning to car-sharing models, there are likely to be far fewer car owners by 2030. However, at the same time individual traffic will increase massively. Personal mileage in Europe could rise by 23% by 2030 to 5.88 billion kilometres. Forecasts predict an increase of 24% in the US and 183% in China.

Aside from population growth, one of the reasons for this is that self-driving vehicles will also be used by people who cannot drive today themselves. Another reason is that the development of fully-autonomous cars means that there are likely to be empty trips, because clearly the ‘robotaxis’ will have to travel from A to B to collect new passengers.

“The roads will definitely become more full”, says Christoph Stürmer. Nevertheless, he does not anticipate chaos – quite the reverse: “Thanks to increasing connectivity, individual traffic will be much easier to organise in the future.” Consequently, the PwC study describes the fourth megatrend as ‘connected’, in addition to the other ‘electrified’, ‘autonomous’ and ‘shared’ megatrends.

One-third more new registrations by 2024 – but who will benefit?

What does this trend mean for manufacturers and suppliers? The PwC scenario assumes that the number of annual new registrations in Europe may increase by one third to more than 24 million cars by 2030; this would be the only way to compensate for the higher wear and tear on cars due to car-sharing concepts. For the US, PwC Autofacts assumes that there could be growth of 20% and new car sales of almost 22 million in the year 2030. For China, a rise of over 30% to 35 million units sold is expected.

This large volume will require car manufacturers and suppliers to make additional investment in new production and development capacity – for new, highly specialised vehicle concepts at much lower prices.

“Automotive groups and their suppliers will have to make critical decisions in the years ahead,” believes PwC’s Christoph Stürmer. On the one hand, while they will have to contend with falling margins – mainly due to pressure from the major fleet operators – at the same time they will have to significantly increase their investment in new factories, electro-mobility and the other megatrends.

Simultaneously, new competitors from the technology industry will see the opportunity to push into the market. A parallel study from PwC strategy consulting firm Strategy& has estimated that conventional players’ share of global industry profits may fall from the current figure of 85% to less than 50% by 2030. Stürmer’s forecast is therefore that: “In this scenario, the only companies that can survive in the long-term are either those that prevail as a clear innovation leader on the product side, or those that recognise that mobility is no longer a product, but rather a service and offer their customers comfortable and low-priced offerings that are simple to use – in other words, offerings that make their life ‘eascy’.”

To download a copy of the report, click five-trends-transforming-the-automotive-industry

PwC purpose is to build trust in society and solve important problems, a network of firms in 158 countries with more than 236,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what matters to you by visiting us at www.pwc.com