- Operational fitness, portfolio rationalization and increased investments in electrification, autonomy and mobility at core of company strategy

- Company increases planned investments in electrification to $11 billion by 2022

- Expanded electrified portfolio to include 40 electrified vehicles globally, including 16 full battery electric vehicles by 2022

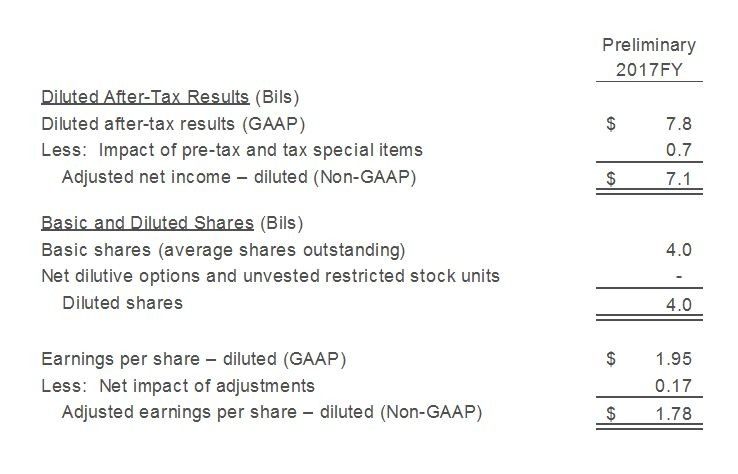

- Announces preliminary results for full-year 2017 of $1.95 earnings-per-share (EPS) and $1.78 adjusted EPS, in line with most recent guidance range

- Declares first quarter regular dividend of $0.15 per share and a $500 million supplemental cash dividend – or $0.13 per share – for a combined $0.28 per share

- Company issues guidance for 2018 of adjusted EPS of $1.45 to $1.70

DEARBORN, Mich., Jan. 16, 2018 – Ford Motor Company (NYSE: F) today detailed plans to improve operational fitness, refocus capital allocation and accelerate the introduction of smart vehicles and services.

Presenting at the Deutsche Bank Global Auto Industry Conference in Detroit, the company provided preliminary results for full-year 2017, issued guidance for 2018 and outlined plans to accelerate investment in electric vehicles and sport utility vehicles.

“In 2017, F-Series extended its streak as America’s best-selling pickup for the 41st straight year, we set a new company high for U.S. SUV sales and Lincoln had its best year since the turn of the millennium thanks to accelerated growth in China,” said Jim Farley, Ford executive vice president and president, Global Markets. “We have a rock solid foundation and we have seen growth in key areas, but we know we must evolve to be even more competitive, and narrow our full line of nameplates in all markets, to a more focused lineup that delivers stronger, more profitable growth, with better returns.”

Bob Shanks, executive vice president and chief financial officer, said Ford is working rapidly to improve its operational fitness and reallocate capital to higher-return opportunities that is expected to fuel profitable growth in the future.

“Since we reinstated a dividend in 2012, we have generated $31 billion in cumulative automotive cash flow, and returned $15.4 billion to shareholders via dividends and share repurchase,” said Bob Shanks, executive vice president and chief financial officer. “Notwithstanding this discipline of returning value to shareholders, we know we can better capture opportunities for growth, profitability and liquidity.”

Ford is further detailing its fitness initiatives first outlined at a presentation to analysts last fall. This includes making changes to products in production today and dramatically improving the efficiency of the business.

For example, the company is reducing the number of orderable combinations on Escape, Fusion and EcoSport from thousands, to just 10 to 20 combinations for each vehicle. This will improve costs by reducing manufacturing expense, lowering inventory and logistics expense and improve quality, while growing revenue by ensuring customers can get what they want faster and at the dealer of their choosing.

The company said it would continue to pursue partnerships, alliances, and acquisitions as a key component to enhance its competitiveness. Ford is pursuing partnerships, alliances, and acquisitions where doing so provides access to technology and capabilities that will enhance its competitive position, including with Mahindra in India and Zotye in China to develop vehicles and services uniquely suited to compete in those markets.

In addition, Ford said it will shift toward a lower volume passenger car lineup in North America and Europe, while competing in more profitable sub-segments of the utilities market, as demonstrated by vehicles such as the new Edge ST and the upcoming Bronco. In North America, for example, over the next couple of years, Ford’s SUV mix will increase 10 percentage points, while its car portfolio will shrink about 10 percentage points.

Ford also will expand its electrified vehicle lineup with a total of 40 vehicles globally, which will include 16 full battery electric vehicles by 2022. To support this, the company announced that it now plans to invest more than $11 billion in electrification from 2015 to 2022. The company also reiterated that it is on track to deliver a full battery electric performance SUV that offers at least a 300-mile range, for launch in 2020.

“We are actively evolving our position to be more competitive,” Farley said. “At the highest level, we need to narrow our full lineup of nameplates to a more focused lineup that delivers stronger growth, less risk and better returns. We are repositioning the company to offer best-in-class, human-centered vehicles and mobility services. That’s our vision.”

Regarding self-driving vehicles, Ford is focused on building an autonomous vehicle business, including a purpose-built vehicle, the self-driving technology and the operational infrastructure in parallel, which will allow it to scale quickly as it enters production in 2021. Collaborations with Dominos, Lyft and Postmates will help validate its self-driving services business beginning this quarter though a series of pilot programs in a new city to be identified soon.

2017 Preliminary Results and 2018 Guidance*

For full-year 2017, the company is announcing preliminary results of $1.95 EPS, an increase of 80 cents from a year ago, and adjusted EPS of $1.78, an increase of 2 cents from a year ago and in line with the company’s most recent guidance. The company also anticipates ending the year with a strong balance sheet with automotive cash of $26.5 billion and automotive liquidity of nearly $37 billion.

2017 results will also include the impact of a non-cash pre-tax remeasurement loss of about $150 million related to the year-end revaluation of global pension and other postretirement employee benefits (OPEB) plans, also known as pension mark-to-market adjustment.

As a result of the company’s performance in 2017, Ford’s Board of Directors declared a first quarter regular dividend of $0.15 per share and a $500 million supplemental cash dividend that is equal to $0.13 per share. This provides a combined total of $0.28 per share of dividends on the company’s outstanding Class B and common stock.

The first quarter regular dividend maintains the same level as the dividends paid in 2017. The first quarter regular and supplemental dividends are payable on March 1, 2018 to shareholders of record at the close of business on Jan. 30, 2018. Subject to the approval of the Board of Directors, the company expects to make distributions totaling about $3.1 billion in 2018. By year-end, cumulative distributions to shareholders will total more than $18 billion since the company’s regular dividend was restored in 2012.

For 2018, the company is guiding to an adjusted EPS in the range of $1.45 to $1.70. This guidance reflects higher commodity costs and further adverse exchange, offset in varying degrees by actions the company is taking to mitigate their effect.

Ford’s presentation at the Deutsche Bank Global Auto Industry Conference will begin at approximately 6:30 p.m. EST today. To access the presentation materials and a listen-only audio webcast, visit www.shareholder.ford.com

*This release include Ford’s preliminary view of 2017 results. Ford’s actual results could differ materially from the preliminary results included in this release. Ford will provide additional detail on 2017 results in its earnings presentation on January 24, 2018. Ford’s Annual Report on Form 10-K, which will be filed in February, will included Ford’s audited financial results.

Note: See table later in this release for reconciliation of the non-GAAP financial measure designated as “adjusted earnings per share” to “earnings per share,” the most comparable financial measure calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). Adjusted earnings per share is a non-GAAP financial measure because it excludes special items. The measure provides investors with useful information to evaluate the performance of Ford’s business excluding items not indicative of the underlying run rate. When Ford provides guidance for adjusted earnings per share, Ford does not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant special items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end, including pension and OPEB remeasurement gains and losses.

Cautionary Note On Forward-Looking Statements

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation:

- Decline in industry sales volume, particularly in the United States, Europe, or China, due to financial crisis, recession, geopolitical events, or other factors;

- Lower-than-anticipated market acceptance of Ford’s new or existing products or services, or failure to achieve expected growth;

- Market shift away from sales of larger, more profitable vehicles beyond Ford’s current planning assumption, particularly in the United States;

- Continued or increased price competition resulting from industry excess capacity, currency fluctuations, or other factors;

- Fluctuations in foreign currency exchange rates, commodity prices, and interest rates;

- Adverse effects resulting from economic, geopolitical, protectionist trade policies, or other events;

- Work stoppages at Ford or supplier facilities or other limitations on production (whether as a result of labor disputes, natural or man-made disasters, tight credit markets or other financial distress, production constraints or difficulties, or other factors);

- Single-source supply of components or materials;

- Labor or other constraints on Ford’s ability to maintain competitive cost structure;

- Substantial pension and other postretirement liabilities impairing liquidity or financial condition;

- Worse-than-assumed economic and demographic experience for pension and other postretirement benefit plans (e.g., discount rates or investment returns);

- Restriction on use of tax attributes from tax law “ownership change;”

- The discovery of defects in vehicles resulting in delays in new model launches, recall campaigns, or increased warranty costs;

- Increased safety, emissions, fuel economy, or other regulations resulting in higher costs, cash expenditures, and/or sales restrictions;

- Unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, perceived environmental impacts, or otherwise;

- Adverse effects on results from a decrease in or cessation or claw back of government incentives related to investments;

- Cybersecurity risks to operational systems, security systems, or infrastructure owned by Ford, Ford Credit, or a third party vendor or supplier;

- Failure of financial institutions to fulfill commitments under committed credit and liquidity facilities;

- Inability of Ford Credit to access debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts, due to credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors;

- Higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles;

- Increased competition from banks, financial institutions, or other third parties seeking to increase their share of financing Ford vehicles; and

- New or increased credit regulations, consumer or data protection regulations, or other regulations resulting in higher costs and/or additional financing restrictions.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2016, as updated by subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

Company Earnings Per Share Reconciliation To Adjusted Earnings Per Share