WESTLAKE VILLAGE, Calif.: 24 October 2013 — While the government shutdown constrained new-vehicle retail sales during the first half of October, the overall pace for the month remains slightly ahead of the running average for the year, according to a monthly sales forecast developed jointly by J.D. Power and LMC Automotive.

| October 20131 |

|

|

|||

| New-Vehicle Retail Sales |

1,016,500 units

(8% higher than October 2012)2 |

916,955 units | 910,505 units | ||

| Total Vehicle Sales |

1,219,500 units

(8% higher than October 2012) |

1,136,354 units | 1,090,662 units | ||

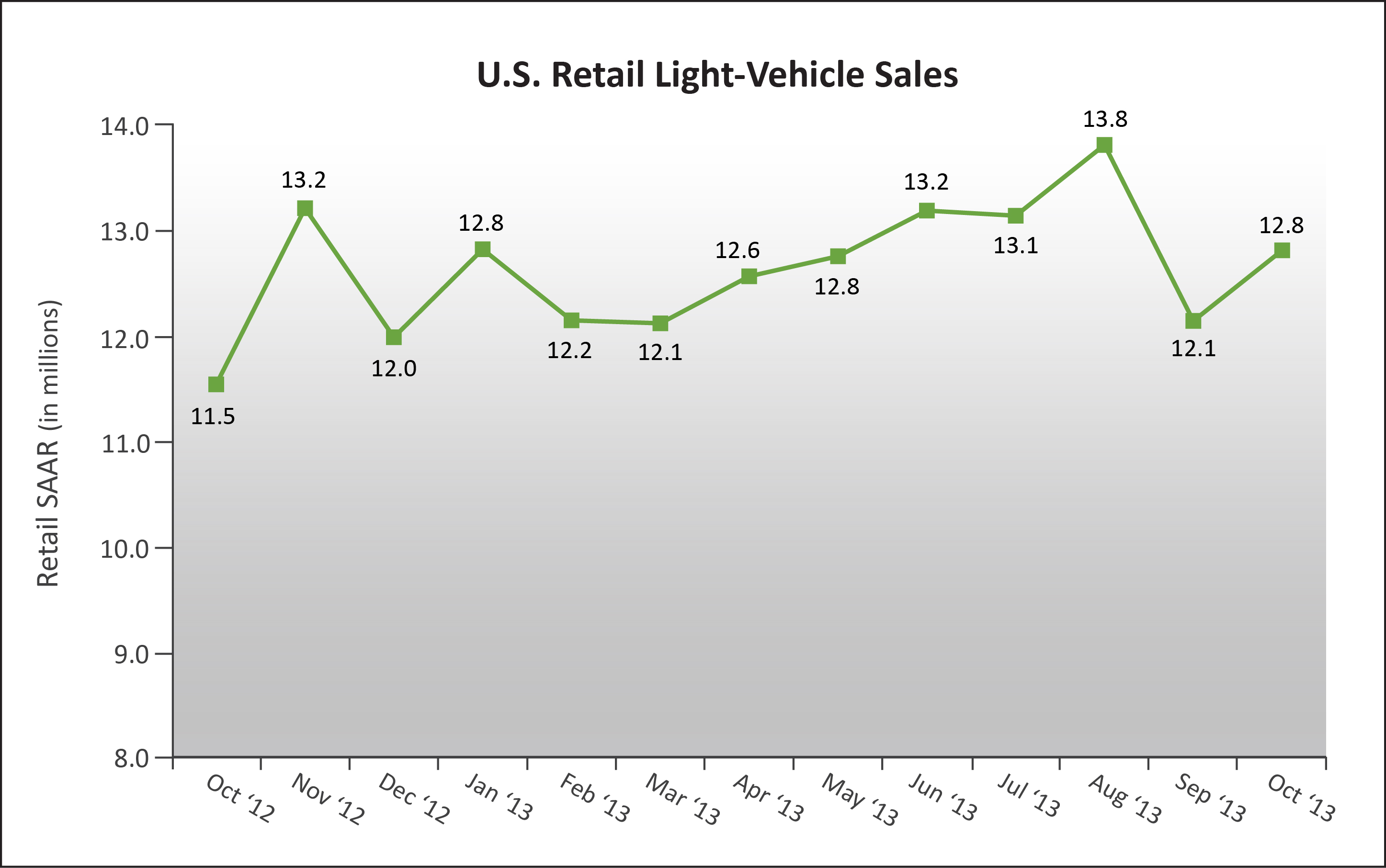

| Retail SAAR | 12.8 million units | 12.1 million units | 11.5 million units | ||

| Total SAAR | 15.4 million units | 15.2 million units | 14.2 million units |

1Figures cited for October 2013 are forecasted based on the first 17 selling days of the month.

Sales Outlook

The sales outlook for 2013 remains unchanged at 15.6 million units. However, with two months of a slight pullback, retail sales are projected to come in at 12.8 million, a slight decline from the previous forecast of 12.9.

“The industry didn’t escape the turmoil in Washington, but the disruption was not enough to stop the auto recovery,” said Jeff Schuster, senior vice president of forecasting at LMC Automotive. “Light-vehicle sales volume north of 16 million units in 2014 is well within reach; however, there is a higher level of risk that consumer confidence could be distracted again in the first quarter if, as expected, the debt ceiling gridlock returns.”

Year-to-date production in North America through September is up more than 4 percent from the same period in 2012. Production in September 2013 was at 1.4 million units, a 13 percent increase from September 2012.

A 63-day supply represents a healthy level that is right in the middle of the 60- to 65-day supply normal range. Schuster notes that given the current selling rate for October, days supply is expected to climb further toward the mid-60-day range, but should not have a negative impact on production levels, as a small inventory buffer may help meet demand as the year closes out.

LMC Automotive has nudged up the volume outlook for 2013 North American production to 16.1 million units from 16.0 million. The overall growth rate is expected to slow slightly in 2014, with volume forecast up 3 percent to 16.5 million units. Leading the way, in terms of growth next year, are BMW, Daimler and Renault-Nissan, all with newly sourced vehicles in North America. BMW, with the X4, and Nissan, with the Murano and a full year of the Rogue, are expected to post double-digit production growth, while Daimler, with the addition of the C-Class, is expected to be up 21 percent from 2013.

About J.D. Power

J.D. Power is a global marketing information services company providing performance improvement, social media and customer satisfaction insights and solutions. The company’s quality and satisfaction measurements are based on responses from millions of consumers annually. Headquartered in Westlake Village, Calif., J.D. Power has offices in North/South America, Europe and Asia Pacific. For more information on car reviews and ratings, car insurance, health insurance, cell phone ratings, and more, please visit JDPower.com. J.D. Power is a business unit of McGraw Hill Financial.

About McGraw Hill Financial

McGraw Hill Financial (NYSE: MHFI) is a leading financial intelligence company providing the global capital and commodity markets with independent benchmarks, credit ratings, portfolio and enterprise risk solutions, and analytics. The Company’s iconic brands include: Standard & Poor’s Ratings Services, S&P Capital IQ, S&P Dow Jones Indices, Platts, CRISIL, J.D. Power, and McGraw Hill Construction. The Company has approximately 17,000 employees in 27 countries.

About LMC Automotive

LMC Automotive, formerly J.D. Power Automotive Forecasting, is the premier supplier of automotive forecasts and intelligence to an extensive client base of automotive manufacturer, component supplier, logistics and distribution companies, as well as financial and government institutions around the world. LMC’s global forecasting services encompass automotive sales, production and powertrain expertise, as well as advisory capability. LMC Automotive has offices in the United States, the UK, Germany, China and Thailand and is part of the Oxford, UK-based LMC group, the global leader in economic and business consultancy for the agribusiness sector.

OCTOBER NEW-CAR SALES EXPECTED TO JUMP 12 PERCENT, ACCORDING TO KELLEY BLUE BOOK

IRVINE, Calif., Oct. 24, 2013 — New-vehicle sales are expected to improve 11.7 percent in October to a total of 1.22 million units, according to Kelley Blue Book, the leading provider of new and used car information. Following the first year-over-year decline in 27 months in September, new-car sales should begin to bounce back in October, despite the federal government’s shutdown earlier in the month. Helping sales, this October has one more selling day than last year, and in 2012, numbers were heavily affected by Hurricane Sandy’s impact on the East Coast. Barring another economic setback, industry sales remain on track to reach about 15.6 million units in 2013.

Key Highlights for Estimated October 2013 Sales Forecast:

- In October, new light-vehicle sales, including fleet, are expected to hit 1,220,000 units, up 11.7 percent from October 2012 and up 7.4 percent from September 2013.

- The seasonally adjusted annual rate (SAAR) for October 2013 is estimated to be 15.4 million, up from 14.3 million in October 2012 and up from 15.2 million in September 2013.

- Retail sales are expected to account for 84 percent of sales in October 2013.

Toyota, Ford Show Greatest Gains in October 2013

Most manufacturers will enjoy healthy sales growth in October. Toyota, whose Camry and all-new Corolla topped the mid-size and compact car segments last month, could post the greatest improvement from last year at 15.9 percent.

Ford also is expected to report excellent sales results this month, driven largely by the demand for their F-Series as well as the recently redesigned Fusion and Escape. Chrysler, Honda and Nissan also are expected to post double-digit gains, largely on the heels of new redesigns and introductions such as the Jeep Cherokee, Honda Accord and Nissan Altima.

“The government shutdown didn’t impact consumers growing appetite for buying new vehicles,” said Alec Gutierrez, senior analyst for Kelley Blue Book. “The expectations were that car buyers would wait on the sidelines, but because of pent-up demand and credit availability, car sales are expected to increase 7 percent from last month.”

| Sales Volume 1 | Market Share 2 | |||||

| Manufacturer | Oct-13 | Oct-12 | YOY % | Oct-13 | Oct-12 | YOY % |

| General Motors (Buick, Cadillac, Chevrolet, GMC) | 212,000 | 195,764 | 8.3% | 17.4% | 17.9% | -0.5% |

| Ford Motor Company (Ford, Lincoln) | 191,000 | 167,947 | 13.7% | 15.7% | 15.4% | 0.3% |

| Toyota Motor Company (Lexus, Scion, Toyota) | 180,000 | 155,242 | 15.9% | 14.8% | 14.2% | 0.5% |

| Chrysler Group (Chrysler, Dodge, Jeep, RAM) | 142,000 | 126,185 | 12.5% | 11.6% | 11.6% | 0.1% |

| American Honda (Acura, Honda) | 120,000 | 106,973 | 12.2% | 9.8% | 9.8% | 0.0% |

| Nissan North America (Infiniti, Nissan) | 90,000 | 79,685 | 12.9% | 7.4% | 7.3% | 0.1% |

| Hyundai-Kia | 95,000 | 92,723 | 2.5% | 7.8% | 8.5% | -0.7% |

| Volkswagen Group (Audi, Volkswagen) | 48,000 | 46,019 | 4.3% | 3.9% | 4.2% | -0.3% |

| Total 3 | 1,220,000 | 1,092,294 | 11.7% | – | – | – |

| 1Historical data from OEM sales announcements | ||||||

| 2Kelley Blue Book Automotive Insights | ||||||

| 3Includes brands not shown | ||||||

Small Crossovers Continue to Shine; Full-Size Pickup Truck Growth Slows

Continuing its trend, sales of compact crossovers will have the biggest improvement in October, with an expected gain of more than 25 percent.

“Consumers are drawn to the new models in the crossover segment, which feature increasingly efficient engines, yet have more cargo space and a higher ride height than their car counterparts,” said Gutierrez. “Meanwhile, after many months of 20 percent gains this year, the full-size pickup truck market is showing signs of slightly slower growth as we move into the 2014 model year.”

Although General Motors has its new Chevrolet Silverado and GMC Sierra on the market, the impact of a recent $1,500 manufacturer’s suggested retail price (MSRP) increase on these trucks remains to be seen. Although the growth in the pickup truck sales appears to be slowing on the surface, sales were already beginning to heat up in the fourth quarter of 2012, so year-over-year comparisons will naturally subside as time goes on.

| Sales Volume 1 | Market Share | |||||

| Segment | Oct-13 | Oct-12 | YOY % | Oct-13 | Oct-12 | YOY % |

| Mid-Size Car | 189,000 | 171,085 | 10.5% | 15.5% | 15.7% | -0.2% |

| Compact Car | 178,000 | 157,214 | 13.2% | 14.6% | 14.4% | 0.2% |

| Compact Crossover | 150,000 | 118,603 | 26.5% | 12.3% | 10.9% | 1.4% |

| Full-Size Pickup Truck | 166,000 | 147,199 | 12.8% | 13.6% | 13.5% | 0.1% |

| Subcompact Car | 54,000 | 47,107 | 14.6% | 4.4% | 4.3% | 0.1% |

| Total 2 | 1,220,000 | 1,092,294 | 11.7% | – | – | – |

| 1Kelley Blue Book Automotive Insights | ||||||

| 2Includes segments not shown | ||||||

About Kelley Blue Book

Founded in 1926, Kelley Blue Book, The Trusted Resource®, is the only vehicle valuation and information source trusted and relied upon by both consumers and the automotive industry. Each week the company provides the most market-reflective values in the industry on its top-rated website KBB.com, including its famous Blue Book® Trade-In and Suggested Retail Values, and Fair Purchase Price, which reports what others are paying for new cars this week. The company also provides vehicle pricing and values through various products and services available to car dealers, auto manufacturers, finance and insurance companies, and governmental agencies.