Johnson Controls Garners Three Segment Awards for Seat Quality;

Avanzar Interior Technologies, Ltd. and Magna Each Net Two

WESTLAKE VILLAGE, Calif.: 14 August 2014 — Automakers are responding to consumer demand for third-row seating, but in doing so are compromising quality and cargo space, according to the J.D. Power 2014 Seat Quality and Satisfaction StudySM released today.

While overall the percentage of new vehicles that offer third-row seats remains stable, some segments have experienced year-over-year increases, such as mass market truck/van (23% vs. 19%, respectively) and mass market compact SUV/MPV (1.7% vs. 0.3 %, respectively), which is relatively new in the third-row seat market.

Although the addition of a third-row seat provides more options for passenger seating, it also creates opportunities for something to go wrong. The mass market compact SUV/MPV segment—the smallest segment in the third-row market—averages 13.0 seat-related problems per 100 vehicles (PP100), compared with the industry average of 11.5 PP100 for vehicles with third-row seating. In contrast, the larger vehicles in the mass market truck/van segment have the fewest seat-related problems (8.6 PP100) among those offering third-row seating. In comparison, the industry average for seat-related problems among vehicles that do not have third-row seating is 8.7 PP100.

The study finds that owners who use their third-row seats for passengers more than once a month experience 0.6 more problems with their seats than those who do not use their third row seats for passengers. The difference in scores is driven primarily by one problem area—seat materials scuffs/soil easily—with owners who use their third-row seat more than once a month experiencing 0.8 PP100 more in this area.

Despite this increase in problems, vehicle owners whose third-row seats are occupied by passengers more than once a month are also significantly more likely to indicate that the comfort and head/leg/foot room of their second and third rows are more appealing than owners who do not use their third-row seats. The downside is that satisfaction with the amount of trunk/cargo area space among these owners is lower than among those who do not use their third-row seats for passengers, as the latter group of owners can more often keep the third row folded down, maximizing the cargo space.

“There is demand on third-row seats and automakers are trying to meet that demand,” said Mike VanNieuwkuyk, executive director of global automotive at J.D. Power. “The challenge is to provide a functional third-row seat that meets customer needs and expectations without compromising quality, comfort and space. It’s easier to do that in a larger vehicle, but automakers and seat suppliers need to find a way to also meet consumer expectations in the growth area, which is smaller SUVs and MPVs.”

Owners who use their third-row seating for passengers are more satisfied with the comfort and roominess of the third row than owners who don’t. VanNieuwkuyk noted that the greater issues are the process of getting into and out of third-row seats; the additional wear, soiling and scuffing that usage creates; and the need to provide options to better manage cargo to offset the smaller cargo space when the third-row seating is in use.

KEY FINDINGS

- ŸThe overall industry average for seat-related problems is 9.1 PP100 in 2014, an improvement of 0.4 PP100 from 2013.

- ŸAmong owners of vehicles with third-row seating, 54 percent indicate the third row is used by passengers at least once a month, with 41 percent of these owners using the third row at least once a week.

- ŸWhen owners experience a problem with a manual seat control, the most common reason cited is that the controls are physically hard to operate. In contrast, owners who experience problems with power seat controls very rarely indicated that the controls are hard to operate; instead, they experience more issues with the placement of the controls.

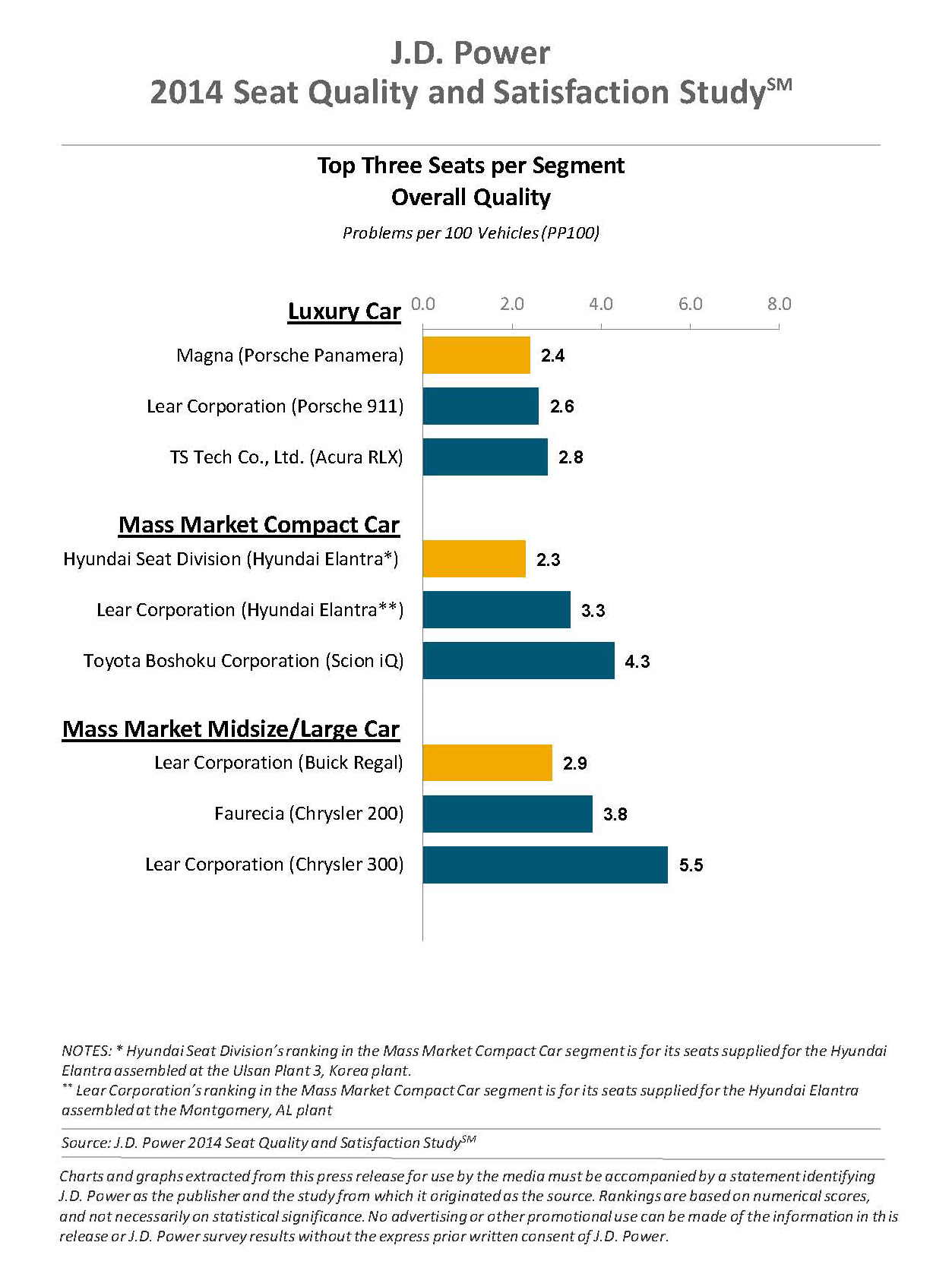

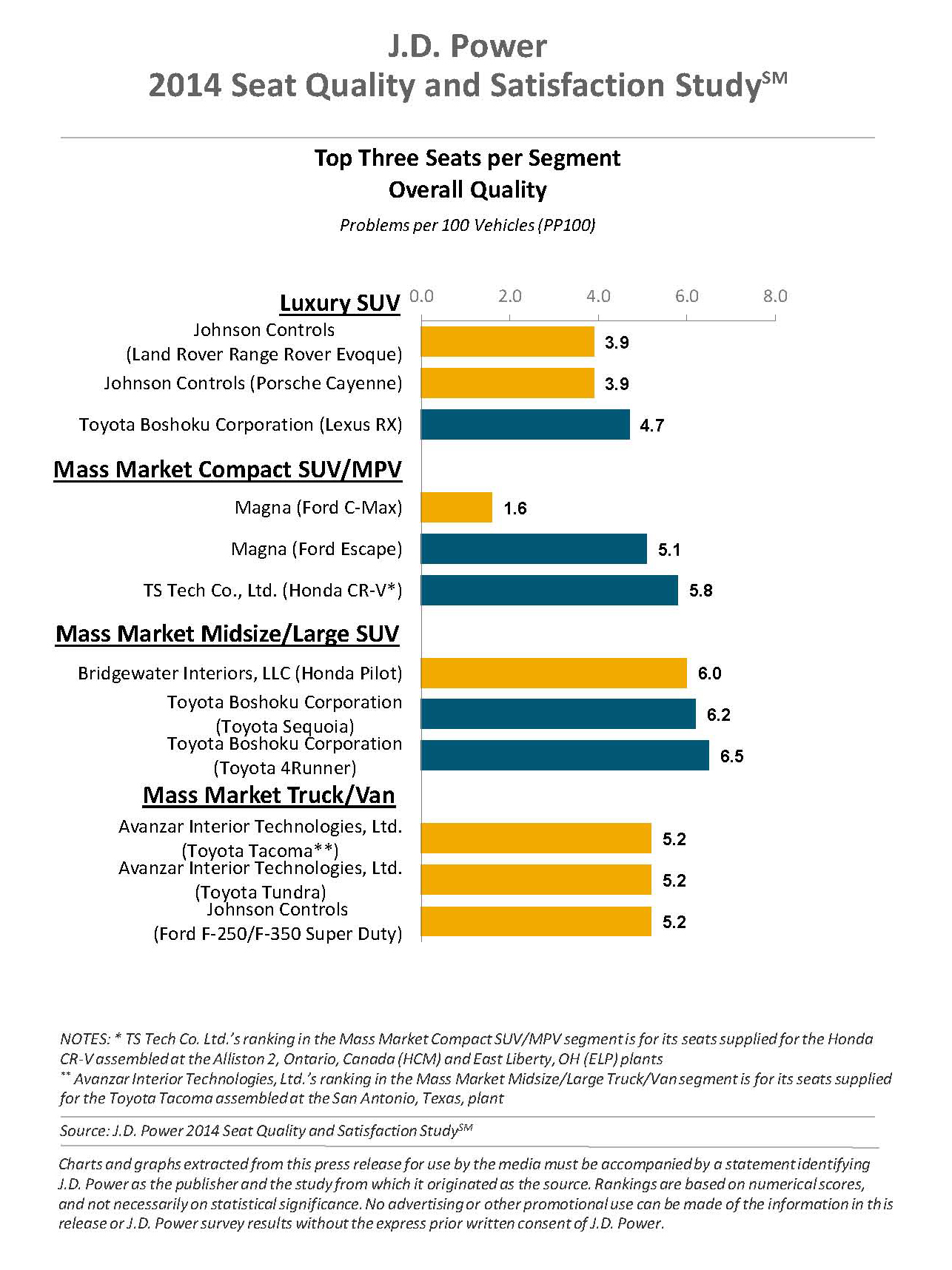

Seat Supplier Quality Rankings

Among seat suppliers, Johnson Controls garners three segment awards for seat quality, while Avanzar Interior Technologies, Ltd. and Magna each receive two awards. Bridgewater Interiors, LLC, Hyundai Seat Division and Lear Corporation each rank highest in one segment.

Johnson Controls ranks highest (in a tie) in the luxury SUV segment for its seats in the Land Rover Range Rover Evoque and Porsche Cayenne. Additionally, Johnson Controls ranks highest (in a three-way tie) in the mass market truck/van segment for the Ford F-250/F-350 Super Duty. Avanzar Interior Technologies, Ltd. ranks highest (in a three-way tie) in the mass market truck/van segment, receiving two awards for the Toyota Tacoma[1] and Toyota Tundra. Magna ranks highest in the mass market compact SUV/MPV segment for the Ford C-Max, and also ranks highest in the luxury car segment for the Porsche Panamera.

Bridgewater Interiors, LLC ranks highest in the mass market midsize/large SUV segment (Honda Pilot); Hyundai Seat Division ranks highest in the mass market compact car segment (Hyundai Elantra[2]); and Lear Corporation ranks highest in the mass market midsize/large car segment (Buick Regal).

The 2014 Seat Quality and Satisfaction Study provides automotive manufacturers and suppliers with quality and satisfaction information related to automotive seating systems. New-vehicle owners are asked to rate the quality of their vehicle seats and seat belts based on whether or not they experienced defects/malfunctions or design problems during the first 90 days of ownership. The study is based on responses from more than 86,000 purchasers and lessees of new 2014 model-year cars and light trucks. The study was fielded between February and May 2014.